Is Acorns Worth It? How One Person Saved And Invested Over $50,000 Using The App

You’ve probably heard of Acorns if you’re looking to stash away money and watch it grow. But you’re probably wondering, “Is Acorns worth it?”

Warren Buffett said it best when it comes to planting the seeds for future financial freedom: “Someone is sitting in the shade because they planted a tree a long time ago.”

What is Acorns?

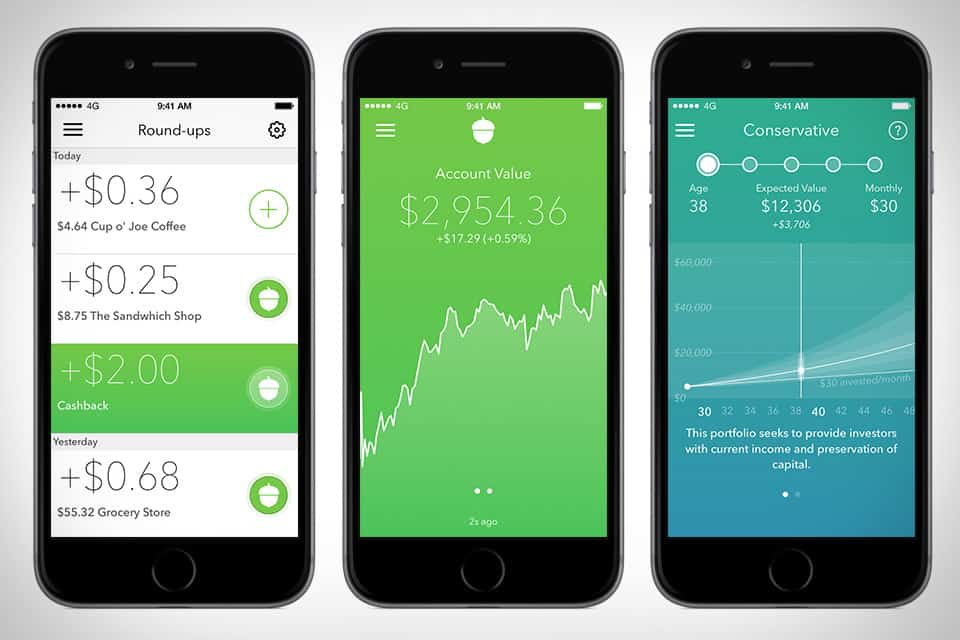

The answer is simple. Acorns is a powerful savings and investing tool. It’s a great way for beginner investors to seek a bigger return on their savings.

It’s extremely popular with millennials, with an easy-to-navigate user-experience for checking in on your progress from your phone.

Think of it as a way of investing spare change automatically.

When you spend money on a synched credit or debit card, Acorns rounds-up the transaction and deposits these accumulated round-ups into an investment account. You can also set reoccurring investments to deposit at a daily, weekly, or monthly interval.

There are also no limits on how many credit cards or account that you can link to Acorns. This allows you to invest your spare changes without limitations.

What are Acorns portfolios?

Acorns smart portfolios are tailored to your investment goals and risk appetite. Acorns portfolios are designed by experts and automatically adjust as you and your money grow.

So where does your money go? There are five Acorns portfolios that you can choose when setting-up your account. As an Acorns customer, these can be changed over the course of your investing journey depending on your financial situation.

The profiles themselves are comprised of popular ETFs:

- Conservative –Comprised of short term government bonds (40%), ultra short term corporate bonds (40%), ultra short term government bonds (20%)

- Moderately Conservative – Comprised mostly of large company stocks (24%) and government and corporate bonds (60%), along with medium company stocks (4%) and international company stocks (12%)

- Moderate – Comprised of large company stocks (35%), medium company stocks (5%), small company stocks (2%), international company stocks (18%), government & corporate bonds (40%)

- Moderately Aggressive – Comprised of large company stocks (47%), medium company stocks (6%), small company stocks (3%), international company stocks (24%), government and corporate bonds (20%)

- Aggressive- Comprised of large company stocks (55%), medium company stocks (10%), small company stocks (5%) and international company stocks (30%). If time is on your side, the Acorns aggressive portfolio might be for you.

The micro and robo-investing app boasts over 9 million customers and $3 billion in assets under management, charing a tiered fee based on product: $1, $3, or $5, with assets up to $1 million.

Is Acorns worth it?

For many beginning investors, Acorns is paying off by accumulating gains via investments in the stock market and other securities over time.

For example, Redditor @TakeAHardLook recently shared the following milestone to the Acorns Investing subreddit. This is a popular an online community where Acorns users discuss their tactics and gains.

TakeAHardLook claims to have started using Acorns in June 2016. According to the post, their portfolio set to moderately aggressive.

Like many Acorn users, TakeAHardLook started small and then gradually started increasing their contribution over time. As of this writing, they claim they’re contributing $250/week with 10X multiplier on their round-ups from credit cards.

So for every $5 in credit card round-ups, they contribute $50 to their Acorns account toward their financial future.

Since 2016, this TakeAHardLook claims to have saved and invested $52,758 dollars using Acorns, with gains of $10,926.

That’s over 26% in market gains! So is acorns worth it? Hard to argue that it isn’t.

Since June 2016. Started small then gradually started increasing to $250/week with 10X round up multiplier. Moderate Aggressive. I love Acorns. from r/acorns

This is great example of how powerful the “set it and forget it” approach is for saving and investing. As one user puts it, setting round-ups to “10x is the way, it punishes me for spending.”

Does Acorns make sense for everyone?

It depends. In the same Reddit thread as mentioned above, another user asked if if makes sense to have a professional manage over $50,000 in savings. Another user with over $100,000 saved in Acorns chimed in:

I don’t think so. I have 140k in acorns, 225 in another professionally managed account and my Acorns is outperforming. It’s doing that because this is a steal. My manager charges 1.14% (in gain and loss years) this is $12 a year. It’s diverse, almost no cost, and is easy to manage and continually contribute to while the other require rebalancing and meetings and so on. This auto splits too which is great.

So is Acorns worth it? For a user like TakeAHardLook, it certainly seems to be.

It’s a great example of why Acorns is such a popular platform, helping millions save small amounts of money with spare change and turning those into small daily investments.

[Photo by Karolina Grabowska from Pexels]