10 Things Rich People Don’t Understand About Student Loan Debt

For those without financial burdens, the long-term effects of student loan debt can seem distant or unrelatable. But for many graduates, debt is a near constant weight on their minds, impacting almost every decision in their lives. Meanwhile, the ultra-wealthy often fail to grasp how this debt limits opportunities, forces sacrifices, and creates stress. These loans aren’t just a monthly payment — they shape the future of millions by influencing their economic and personal well-being for years to come. Here are 10 things rich people just don’t get about student loan debt.

1. Career Choices

Student loan debt often forces graduates to prioritize high-paying “safe” jobs over career growth or roles that they’re actually passionate about. The result? Many end up slaving away in jobs they don’t enjoy just to meet financial obligations. On the flip side, the wealthy may not understand how having debt can trap people in fields they never aspired to work in.

2. Delayed Homeownership

For those saddled with student debt, purchasing a home is not something that’s easily attainable. The weight of debt affects credit scores and savings, making banks less likely to offer good mortgage rates or approve loans at all. The ultra-wealthy may not realize that, for some, homeownership remains out of reach for years or even decades.

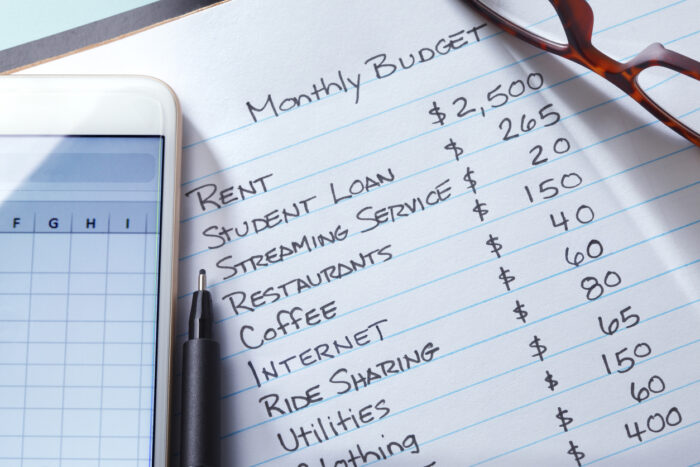

3. Everyday Budgeting

Debt repayment can consume a significant portion of your income, leaving little room for leisurely spending like dining out or traveling. For graduates with a lot of debt, they may even be forced to choose between essential needs like paying for healthcare or budgeting for rent and groceries. Meanwhile, the rich may not understand how every single budgeting decision revolves around debt.

4. Mental Health Strain

The pressure of student loans can lead to anxiety and stress, as people struggle to keep up with payments while managing life’s other demands. The wealthy, who don’t experience this constant financial weight, might overlook how much it impacts their mental health. This burden can seep into every facet of life, from relationships and sleep quality to work productivity.

5. Limited Savings for Retirement

Student debt often causes people to delay saving for retirement because they’re focusing on paying off their loans first. While those without financial burdens can start saving and building wealth early, many graduates fall behind in preparing for their futures. The ultra-wealthy may not understand how debt can create long-term financial insecurity for others.

6. Postponing Marriage or Starting a Family

Many people burdened with student debt are forced to delay significant life events, such as marriage or having children. The added expenses of student loans make it super difficult, or even impossible, to afford these milestones. For the rich, these life choices may come easily, but for debt-holders, they require strategic planning and a good share of sacrificing.

7. Interest Rates and Accruing Debt

Because interest on student loans compounds over time, this can sometimes double the original loan amount before it’s fully paid off. This ongoing accumulation makes it even harder to escape debt (not to mention adding to the mental strain). The wealthy, who don’t often borrow money for education, may not realize the burden (and, let’s be real, the outrage) of watching loans grow despite making payments.

8. Wage Stagnation

Those burdened with student debt often face stagnant wages that don’t keep pace with inflation or loan payments. Even after working for several years (some even work more than one job), their financial situation may not see much improvement. The wealthy likely don’t understand how this impacts financial progress and makes those who have student loan debt feel as if they’re stuck in place.

9. Forgoing Investments

With much of their money tied up in loan repayments, those saddled with debt may miss out on investment opportunities that could improve their financial standing. Meanwhile, the rich and privileged have access to investments that expand their financial portfolio and help them build long-term wealth. This gap in financial opportunities perpetuates income inequality.

10. The Emotional Toll of Never Feeling Free of Debt

For those with student loans, the dream of being debt-free can feel out of reach, with payments stretching for years, or even decades. This emotional toll can weigh on their sense of freedom and financial security. The ultra-wealthy, often unfamiliar with long-term financial burdens, might not be able to grasp the constant stress and frustration debt creates.

The saying “the rich get richer while the poor get poorer” often rings true, as debt compounds these financial challenges.