How Much Should You Have Saved For Retirement By Every Age? Here’s The Answer

Retirement savings can be a daunting thing to think about for most people. But don’t fall prey to the worry and just quit. That will leave you with a really tight budget during your retirement – your golden years! — and no one wants that. Once you understand how much money you should have saved for retirement by 30, 40, 50 and beyond, you’ll be able to make a pain and take action

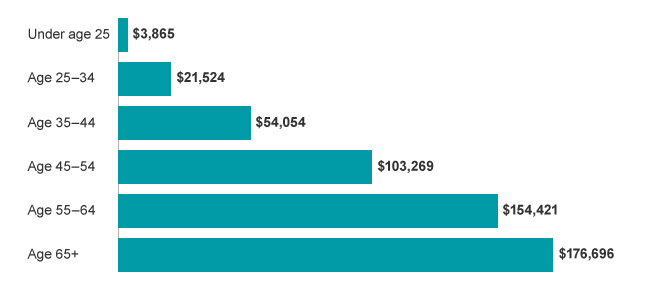

To ease your fears about your own savings, let’s look at this chart of the average retirement savings by age. As you’ll see, all is not lost. And you likely still have time to be well above average by the time you hit age 65.

Average Retirement Savings By Age In America

The chart above is the reality of what Americans, on average, have in our retirement savings accounts. It is not what is suggested by financial experts.

Here is what Fidelity suggests that you should have in your retirement savings by age:

- 30: 1x annual salary

- 40: 2x annual salary

- 50: 4x annual salary

- 60: 6X annual salary

- 67: 8x annual salary

It is worth noting that these numbers are attainable by starting to contribute 15% of your annual income to your 401K (or other self-funded investment accounts) at age 25.

Determining Your Personal Retirement Goals

There are several different ways to calculate what you really need saved for retirement to live a fulfilled life.

First, you want to figure out how much income you’ll need in retirement. That is where the 80% rule comes in.

1. Retirement Income: Follow The 80% Rule

Your yearly retirement income should be about 80% of your final pre-retirement salary. Meaning, if you’re earning $200,000 annually at time of retirement, you will need $160,000 per year in retirement income (401K, passive income, side hustles) to continue having the same quality of life in retirement.

Is that a flawed rule? For super savers and people who live frugally, of course it is. But there is nothing wrong with having that extra cushion for unexpected health care costs or other financial emergencies.

Next, you need to determine how big your retirement nest egg needs to be. One popular method of doing that is the 4% Rule.

2. The 4% Rule

There is it. The 4% Rule.

If you’re unfamiliar with the 4% Rule, it is just a way to determine the amount of retirement savings you will need to achieve your desired annual retirement income.

Example:

Your Desired Retirement Income is $160,000

Next you take $160K and divided it by 4% to see how big of a retirement nest egg you need.

$160,000/.04= $4,000,000

Of course markets aren’t perfect and some years you might make 20% while others you see a negative return. There is also no guarantee that the market will continue to go up in the future. But don’t fret, the average annual yield of the S&P 500 over the last 30 years is 12%.

Finally, you need to figure out your retirement savings rate to achieve your goals by your desired retirement date.

3. How Much Can You Save?

Everyone’s financial situation is different. If you’re young, you have time on your side. Getting in the habit of investing whatever you can in your 20s is just as important as the amount you save. Heck, if you want to be a millionaire by 40, it is pretty easy if you start young enough. The older you get, however, achieving your financial goals gets a lot harder. So of you’re closing in on 40, you need to be way more aggressive and 15% will likely not be enough to reach your goals.

So what can you do?

It’s simple.

- Determine what you want your income to be in retirement.

- Figure out the net worth that it will take to achieve that income.

- Plug your age and timeline into an investment calculator to determine what your saving/investing rate needs to be.

After that, be consistent in your investing and 401k contributions. And try to rest easy knowing the market historically always goes up.