How To Put Your Money To Work With Stash

Investing in stocks used to be reserved for the wealthy or the knowledgeable. However, as the stock market grew in popularity and as technology evolved, investing is accessible to many more people.

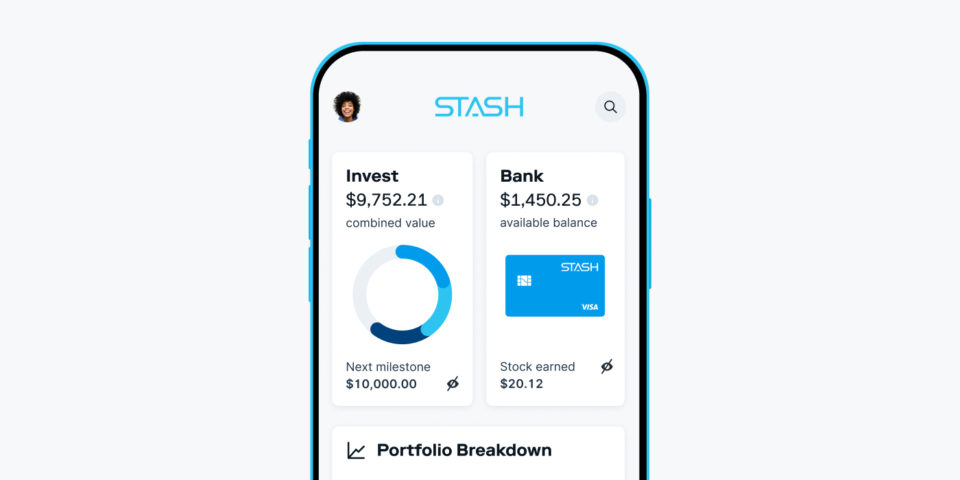

With just your smartphone, you can start investing your money with just $5. This is especially true for one of these micro-investing apps of today, Stash. Stash can make investing your money online easier and more affordable.

This article will teach you everything you need to know about this app as well as tips on how to use Stash.

What is Stash?

Stash is a mobile app and web platform developed in 2015. It was made after its developers observed how difficult it was for most Americans to invest their money. To make investing easier for the ordinary American, Stash was born.

Stash allows you to invest in thousands of stocks and funds with unlimited trading and no add-on trading commission.1 One of Stash’s main features allows its users to learn as they start investing. Learn, earn, and save – these are the pillars of Stash when it comes to helping people reach their financial goals.

What Can Stash Do for You?

As a micro-investing app, Stash allows you to buy fractional shares. These are parts of a whole stock, as its name suggests. This is one of the creative ways you can start investing your money with little capital. Many stocks are too expensive for an average person to be able to afford a full share, so fractional shares are gaining ground today.

Fractional shares can enable you to invest in multiple funds, depending on what you can afford. This flexibility can be leveraged for people who wish to buy a stock that has a higher price per share and don’t want to spend much on a trade.

With Stash, you can additionally invest in a curated selection of exchange-traded funds (ETF’s) Stash can provide personalized recommendations based on your risk tolerance, allowing for a unique and tailor-fit investing experience for everyone.

How Can You Start?

As with a regular app, the first thing you need to do is download it. You can get it from the App Store or in Google Play Store. As of date, the app is only available in the U.S. You can choose from three different subscription plans that are based on the type of investor you want to be, and pricing ranges from one to nine dollars per month.

Beginner

With $1, the beginner package is the lowest priced plan. It includes the basics such as getting access to a personal investment account, an online banking account, and the Stock-Back® Card(2).It also gives you access to their Learn educational center while using the app.

Growth

At $3, the next package includes all previous features with the addition of access to a retirement account (3) You can have a separate account dedicated to your retirement.

Stash +

Priced at $9, the last and most expensive package they offer, introduces a few new features. This time, access for up to two investment accounts for kids. You also get access to with 2x Stock-Back® rewards. This plan also gives you monthly market insight reports and educational tools.

After choosing your plan, you register by creating your profile. This includes basic information such as your email, name, birthday, and others. However, your basic profile is just the beginning. You also need to set up your investment profile.

What Type of Investor Are You?

In building your investment profile in Stash, the system will ask you questions to determine what kind of investor you are. These questions are based on what risks you may want to take and the gain you want to attain. The first question covers most of this by asking the expectations you have for investing. Are you a conservative investor? An aggressive one? Or are you somewhere in the middle? A moderate investor, perhaps? For beginners, you should evaluate your options and weigh them smartly.

Other questions include your employment status and the money you make. It also asks you when you will spend the money you save and invest. These questions may seem personal, but these are information that can help determine what type of investor you are and can be. This is also linked to Stash creating personalized guidance for you.

How Can You Actually Invest?

To start investing, Stash gives you the option to select how much you want to automatically put in the market every week. You can also choose to make the investments you can afford, whenever you can afford them. As mentioned previously, five dollars is enough to jumpstart your investing journey. However, you can always choose to invest more. Stash allows you to link your bank account for easier cash-in transactions. What’s more, your banking account has no overdraft or hidden fees.4 You can maximize the technology Stash has to offer.

One of their Stash’s best features is their automated functions. Automatic saving tools such as the Auto-Stash allow you to decide how much you will save or “stash” regularly and how often, and you can schedule it as you wish. This means the money you have from your linked bank account can automatically go to your chosen investments. It can also be a way for you to not forget investing regularly, which is a common mistake of first-time investors.

Another tool that can help you invest more regularly is their Round-ups feature. This tool helps you automatically save the loose change from your purchases.

If you are not yet ready to automate your investing, you can always learn the ropes of in Stash first by going to their “Learn” tab. This section teaches the basics of financial planning, investment terms, and more. It also has a Frequently Asked Questions (FAQs) page that could help ease your mind. Aside from these, Stash also has a set of suggested action steps for you – from choosing your first investment to adding and combining more investments.

When you are confident enough to start investing, you can opt for the automated functions. After choosing your investments, you can now continuously save, invest, and monitor your money on the app. Patience is key.

What Else Can You Do with Stash?

Stash also has their Stock-Back® Card (2) so you can get pieces of investments as a reward when you swipe your card. From simple tips to articles, Stash allows you to determine what you are getting yourself into with the StashLearn section. .

Is Stash Worth It?

Yes. True to its promise, the Stash app allows people to have a simplified investment experience. From the moment you sign up, you are guided with their recommendations. This is helpful, especially for beginners who may not know the different risks in investing. It is a good starting place to start investing and a great way to learn more about investments along the way.

******