The Long Term Impact Of Investing An Extra $100, $500 And $1000 Per Month

Almost anyone can get rich slowly. Of course, everyone’s financial circumstances are different, but if you have excess cash dying in a savings account or you’re a compulsive over-spender, becoming a millionaire is possible.

How do you do that? By changing your financial habits. Invest first, spend second. Become committed to investing every, single month. Automate your investments and only after you pay yourself do you get to splurge on things you want.

And if you have financial circumstances that make it almost impossible for you to invest, then you should consider getting a side hustle. As you’ll see below, starting with even $100 per month can make a huge financial difference in the long run.

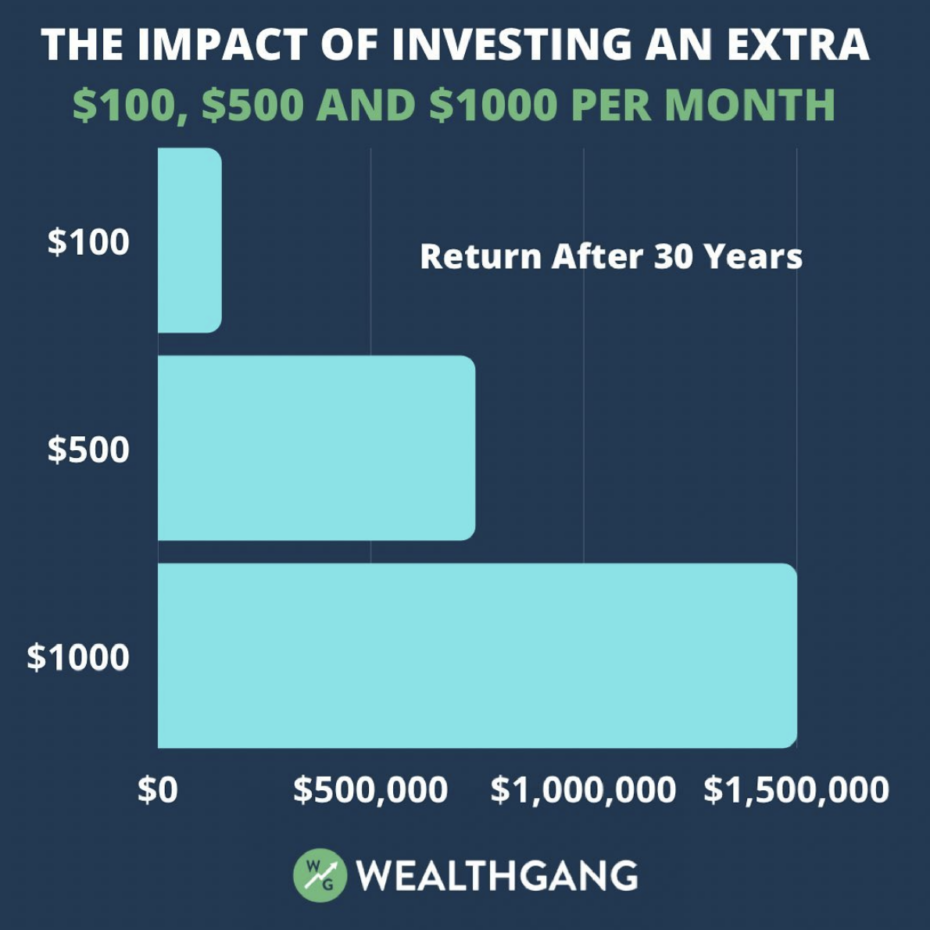

Without further ado, let’s see what the impact of investing an extra $100, $500 and $1000 per month over 30 years will have on your net worth.

These numbers have been calculated using an average annual return of 8%. Most ETFs (VTI, SPY, etc) will get you that or more over 30 years.

The exact numbers of investing extra money per month are as follows:

Investing an extra $100 per month yields roughly $149,000 in 30 years.

Investing an extra $500 per month yields roughly $745,000 in 30 years.

Investing an extra $1000 per month yields roughly $1,500,000 in 30 years.

Look, we get it, 30 years from now is a long time. But the delayed gratification of having an extra $1.5 million in retirement is worth far more than most things you’ll waste that money on today.