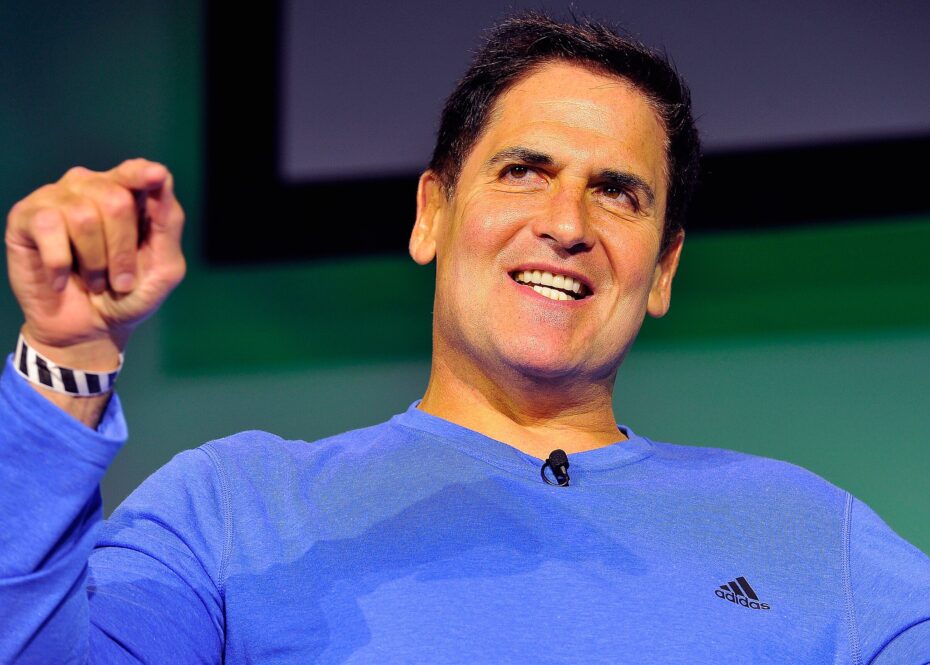

Here’s The One Investment Mark Cuban Thinks Is Best For The Average Person, Plus One He Hates

As a society, we are fascinated by billionaires and their opinions on all things related to making money. Why is that? Probably because they are billionaires! They clearly did something right to accumulate all that wealth. And when Mark Cuban opens his mouth about investing, people tend to listen. Even if he isn’t always right.

In an unearthed interview with Kitco News from 2018, Cuban chimed in on what he thinks the best investment is for the average person and what he thinks is the absolute worst.

What Investment Does Mark Cuban Hate?

“I hate gold. Gold is a religion,” the billionaire owner of the Dallas Mavericks recently told Kitco News. “As an investment, hate is not strong enough. Hate with extreme prejudice as an investment … hate with extreme prejudice is not enough, hate with double extreme prejudice with an ounce of hot sauce.”

Although Cuban was once a naysayer of Bitcoin, he also admitted that Bitcoin has some valuable attributes that gold will never possess.

“The good news about bitcoin is that there’s a finite supply that’ll ever be created, and the bad news about gold is that they’ll keep mining more.”

That’s probably why Cuban thinks the number of people who own Bitcoin will double in the near future.

What Investment Does Mark Cuban Love?

“The best investment you can make is paying off your credit cards, paying off whatever debt you have,” he says. “If you have a student loan with a 7% interest rate, if you pay off that loan, you’re making 7%, that’s your immediate return, which is a lot safer than picking a stock, or trying to pick real estate, or whatever it may be.”

Not all debt is created equally, but Mark Cuban is right, debt with high interest rates attached is crippling. There is a reason why people who love the F.I.R.E. (Financial Independence Retire Early) movement eschew buying or leasing new and expensive cars. There is also a reason why older millennials regret taking on so much student debt.

Debt can ruin you financially. So the quicker you can eliminate it, the better. And, the quicker you eliminate it, the quicker you can start investing in income generating assets.