Investment Advisor Says You Need This Much Saved For Retirement Based On Your Income

Retirement is a significant milestone that usually requires years of financial planning to achieve. Unless, of course, you win the lottery. In which case, hooray for you. That said, many Americans have saved far less for retirement than experts recommend, with the majority having only $65,000 saved, according to data from the Federal Reserve.

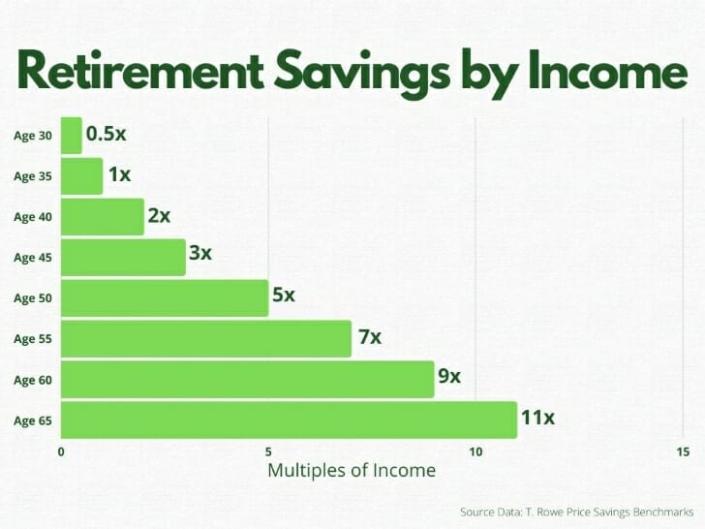

Recently, T. Rowe Price released an updated guide that provides retirement savings estimates based on income levels. Another well-known investment firm, Fidelity Investments, also offers its own retirement savings guide, albeit with different figures.

One effective approach to planning for retirement and selecting suitable investments aligned with your financial goals is to consult a qualified financial advisor. They can provide personalized guidance tailored to your specific needs.

Approaching Retirement? T. Rowe Price Says You Need This Much Saved Based on Your Income

T. Rowe Price has calculated that the amount of money required for retirement by age 65 depends heavily on income. Roger Young, the Thought Leadership Director at T. Rowe Price, explains that “higher earners will get a smaller portion of their income in retirement from Social Security, [so] they generally need more assets in relation to their income.”

As a result, individuals aiming to retire around age 65 should aim to save between seven and 13.5 times their pre-retirement gross income. The following chart illustrates how these savings targets vary by age group:

However, the recommended savings range widens significantly as individuals approach retirement. For instance, a married couple with two earners making $75,000 gross annually should have approximately five times their income saved for retirement by age 55. In contrast, a couple making $250,000 a year should aim to save seven times their income by the same age. T. Rowe Price’s calculation incorporates estimated government benefits, which vary depending on income.

On the other hand, Fidelity recommends saving more at a younger age and catching up less as individuals age. According to Fidelity’s guidelines, earners should have one times their salary saved by age 30, two times by age 35, four times by age 45, and reach seven times their salary by age 55. Fidelity assumes a relatively low annual real wage growth of 1.5%, and front-loading retirement savings allows individuals to benefit from compounding returns.

It is important to note that the appropriate savings amount for an individual will depend on their disposable income and their ability to save realistically without making any big retirement savings mistakes. Federal Reserve data reveals that the average individual aged 55-64 has saved approximately $408,420 for retirement. However, the median savings for that age group is only $134,000. Consequently, while retirement savings goals are crucial, some workers may struggle to set aside such a significant portion of their income.

If you find yourself starting to save for retirement later or needing to tap into your retirement savings for unexpected expenses, reaching the target of saving seven times your salary might appear unattainable. Nevertheless, it is never too late to work towards your financial goals. The 2020 Economic Well-Being of U.S. Households Survey discovered that 42% of non-retirees who were laid off in 2019 had no self-directed retirement savings, emphasizing the importance of taking action.

Both T. Rowe Price and Fidelity suggest that saving 15% of income per year, including any employer contributions, is an ideal savings rate for many people. Higher earners who anticipate receiving fewer Social Security benefits should aim to save beyond this threshold. If you require assistance in formulating a plan to reach your retirement goals more efficiently, a financial advisor can provide valuable guidance.