Stats Show The Oldest Millennials Are Way Behind On Building Wealth – Here’s How They Can Save Themselves

The oldest millennials — lovingly referred to as “geriatric millennials” — are turning 42 this year. Unlike the generations before them (gen X, baby boomers and the silent generation), millennials have gone way off the rails financially. And for older millennials, it is time to take a long, hard look in the mirror and at their finances to make sure they are on track to build wealth and eventually retire comfortably.

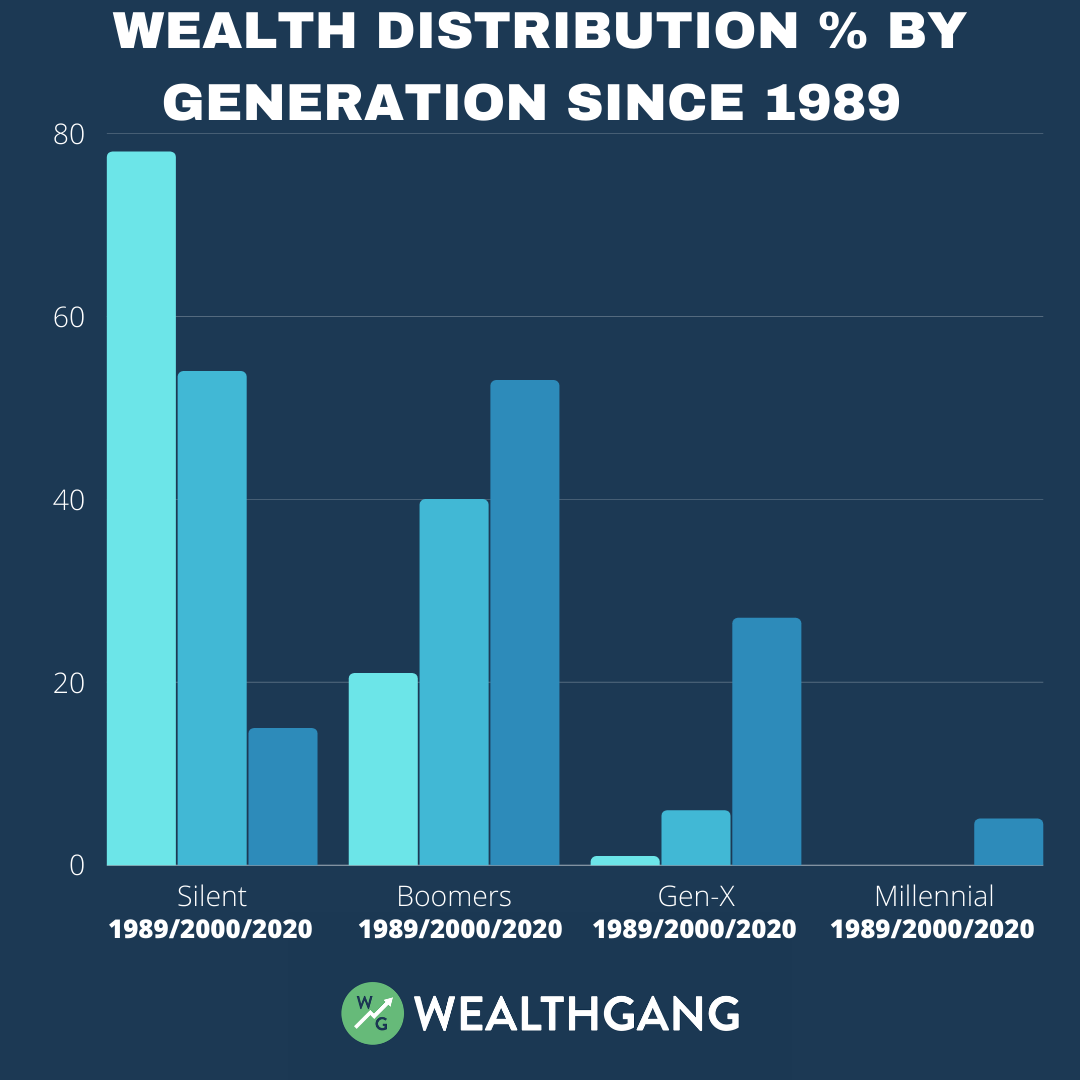

According to data from the Federal Reserve, the oldest millennials are not only saddled with debt, but they are behind previous generations when it comes to net worth. In fact, millennials only own 2% of the wealth in the entire country. When baby boomers were the same age, they owned over 20% of the country’s wealth in 1989.

How did millennials fall so far behind?

For starters, wages have been very stagnant. They have only risen 20% since 1989. While home prices have risen over 33%.

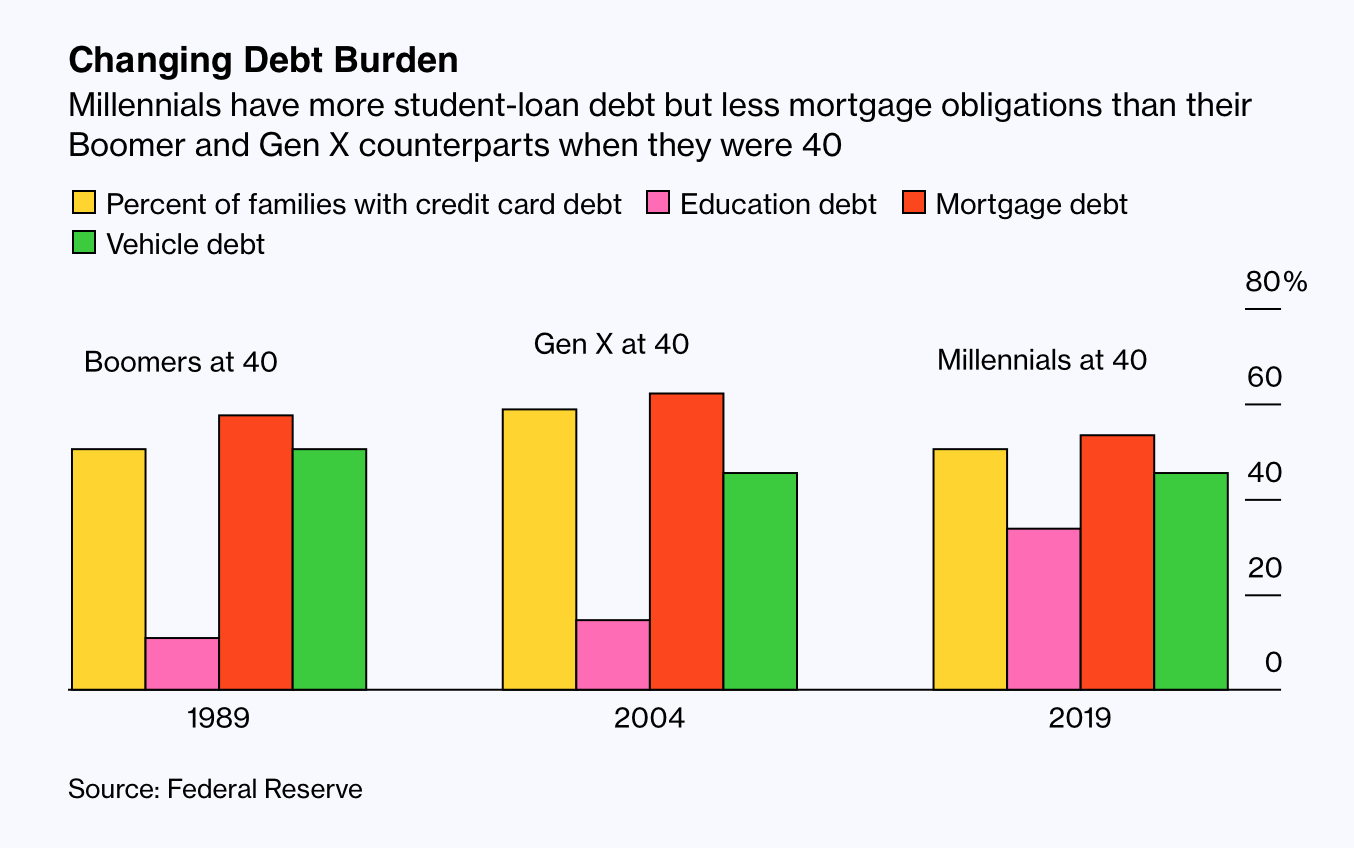

Debt is also a big factor. College was more expensive for millennials and many took on student loans that they regret.

When you add up all these financial roadblocks it is no wonder that millennials account for only 2% of the country’s wealth. In terms of net worth comparison, they are 20% behind the average baby boomer net worth at the same age. In 1989 the oldest boomers had an average net worth of $113,000, while the oldest millennials only have $91,000 as of 2019.

How can millennials get back on track?

First..

Try to eliminate all outstanding credit card and student loan debt. If you’re burning $600 per month on a car payment, think about buying a more reasonably priced used car and drive it to the grave. Mortgage debt is generally fine as long as you wouldn’t consider yourself “house poor.”

Second…

Calculate how much it will take to comfortably retire. There are a number of ways to do this, but we’ve recently posted a very easy way to calculate your freedom number.

Third…

Create a budget and a plan of action. Understanding how you’re spending money will ultimately help you save and invest more. And the more you save and invest, the sooner you can achieve financial freedom.

Finally…

Stick to your plan and automate your savings and investments.

Here is a quick example of what it will take a 40-year-old to have a net worth of $2 million by age 60. Since the national average of net worth for the oldest millennials is currently $91,000 we will use that as the starting point.

- Age: 40

- Retirement Target Age: 60

- Average Annual Return: 8%

- Monthly Investment To Reach $2mil: $2,650

Considering the median household income in the United States in 2020 was $68,400, investing $2,650 per month is a lot of money to most people. The good news is, older millennials who are way behind the curve would only need to save and invest $1,000 per month to hit $1 million by age 60. And with people living longer, waiting till age 65 to retire would give your investment accounts a sizable boost. In fact, if you were to invest $2,650 per month, those extra 5 years of employment would take your account over $3 million.

All hope is not lost, fellow millennials. There is time, but it is running out.