7 Reasons Why Real Estate Crowdfunding Should Be Your Favorite Passive Income Stream

We’re obsessed with creating new passive income streams. More accurately, we’re obsessed with creating truly passive streams of income. You know, the kind where you have to do zero work in order to get paid every month or quarter? That is precisely why we are so enamored by real estate crowdfunding.

If you’re familiar with real estate crowdfunding, then you have probably already heard of some of the biggest players in the space like CrowdStreet, Fundrise, Roofstock and Realty Mogul. And today we want to give you a few reasons why you should add this asset class to your investment portfolio.

Why Real Estate Crowdfunding Is Your New Favorite Passive Income Stream

It Is Truly Passive

Using your money to make even more money is the greatest — and laziest! — form of passive income there is. Sure, you could build passive income streams through hard work and hustle, but if you want to kick back and let money come in while you do literally nothing, then real estate crowdfunding is for you. Why is that? Well, the rest of the reasons will hopefully explain that.

Real Estate Crowdfunding For Non-Accredited Investors Exists

Believe it or not, you can start investing in real estate crowdfunding deals with as little as $500 on Fundrise. But Fundrise isn’t the only player in town. Non-accredited investors are also able to invest on Realty Mogul, however, the initial investment minimums for that are $5000.

All three platforms offer investments specifically for accredited investors as well. However, the ability for non-accredited investors to start investing in real estate without having to make $200K per year and have a net worth of $1,000,000 is a major step in the right direction.

Comprehensive Due Diligence

There is no such thing as a sure thing, especially when it comes to investing. But the amount of vetting done by these companies before accepting a deal will make you sleep a little better at night.

To give you an example of just how intense the due diligence process is, RealtyMogul claims that in the last decade, they have received over 30,000 real estate deals submissions and they have only accepted 337 of them. That is 1%!

High Distribution Yields

One of the main reasons people invest in physical rental real estate is to enjoy the monthly income it provides. And while real estate crowdfunding might not yield as much return as owning your own property, it also requires less capital to start and your entire year’s worth of cashflow won’t be wiped out when a water heater needs to be replaced.

On most of the platforms we’ve mentioned, accredited investors can pick and choose the exact projects to invest in. So if you’re looking for monthly or quarterly distributions, then real estate crowdfunding is for you. In fact, while some investments have distributions similar to dividend ETFs or stocks, we’ve found some massive expected yields on CrowdStreet. Several of them have target average cash yields from 8-10% and a handful even higher than that.

Portfolio Diversification & Deal Flow

It could take you decades, or a lot of leverage, to build a diversified portfolio of physical real estate. Crowdfunding provides that with far less money (and headaches). It also provides you with access to deal flow that you likely couldn’t find, or afford, on your own.

Varying Risk Profiles

Whether you are willing to take on more risk or you want to do anything to preserve your capital while you collect distributions, all of the platforms we mentioned earlier can provide that for you. And, again, unlikes owning your own apartment building or rental property, if something (or a lot of things) needs to be fixed, it won’t wipe out all of your profits. You can sit back and collect your 6-18% returns per year, knowing that is someone else’s problem.

Consistent Historical Income Generation

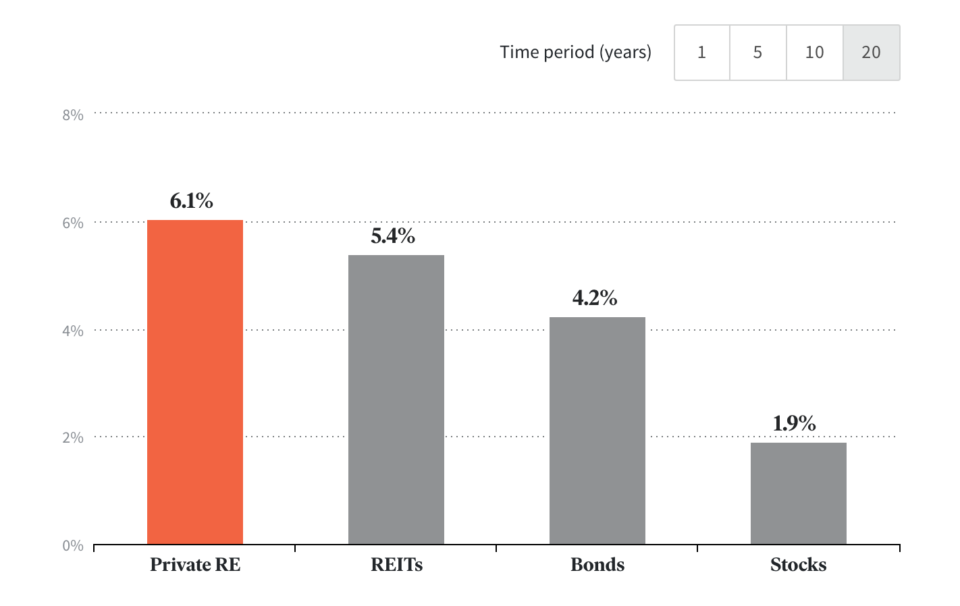

According to Fundrise, private real estate deals have produced a historical yearly income yield greater than any other traditional asset class. Per “The income component of the NPI (the index that tracks private real estate performance), has averaged a higher rate than the yields of these other major asset classes.”

Don’t just take their word for it, look at this graph of 20 year historical income yields from Private Real Estate, REITs, Bonds and Stocks.

What To Consider Before Choosing Real Estate Crowdfunding

The pros of real estate crowdfunding are hopefully obvious at this point. But one should always consider the cons before investing as well. And, while there aren’t many cons to real estate crowdfunding, the most glaring would have to be the lack of liquidity. Unlike stocks, you can’t day trade or swing trade real estate. So you must plan for your initial capital to be tied up for at least two years, and usually longer.

Fees are also something that should be considered. Most platforms have between a 1-3% annual management fee.

Finally, you need to determine what platform is best for you based on how much you can invest, your risk tolerance, the ROI range you’re looking for, and how long you want to have your money tied up in an investment. Each offers something different, but all of the platforms (CrowdStreet, Fundrise, Roofstock and Realty Mogul) are credible.