11 Best Online Trading Platforms That Aren’t Robinhood

Investing excess capital is how wealth is created. Whether those investments come in the form of passive income businesses, stocks or real estate, is up to the individual. But savings alone won’t grow your retirement savings. You need to invest. And, thanks to the Internet, you can now start investing in stocks, real estate or build an entire business with a click of a button. The focus of this post is to highlight the best Robinhood alternatives, AKA online trading platforms that aren’t Robinhood.

What makes a good online trading platform? What should you look for in choosing the one that would meet your investment needs? Check out our list below, they all make it easier for you to start investing online. As always, trade and invest your money responsibly. Or don’t. Your choice!

But seriously, do invest wisely. If you need to, get advice from the pros. Because there’s no shame in asking for help.

1. Public

Public is gaining more and more traction as one of the best investment apps on the market. This online trading platform is a great Robinhood alternative because it uses technology to help online investors make better trading decisions. And its ease of use is perfect for beginners. Another one of the main draws to Public is the ability to buy fractional shares of a company, because that makes investing more inclusive! Which is exactly how it should be.

Pros:

- Commission free trades and no investment minimums.

- ETF trading is available with no fees.

- Uninvested cash earns a high yield which allows it to double as a savings account.

Cons:

- You can’t day trade on the platform. If you’re interested in flipping stocks or daily swing trading, this might not be the platform for you.

- The platform is mobile only.

- There is currently no desktop version.

Start Investing With Public Today!

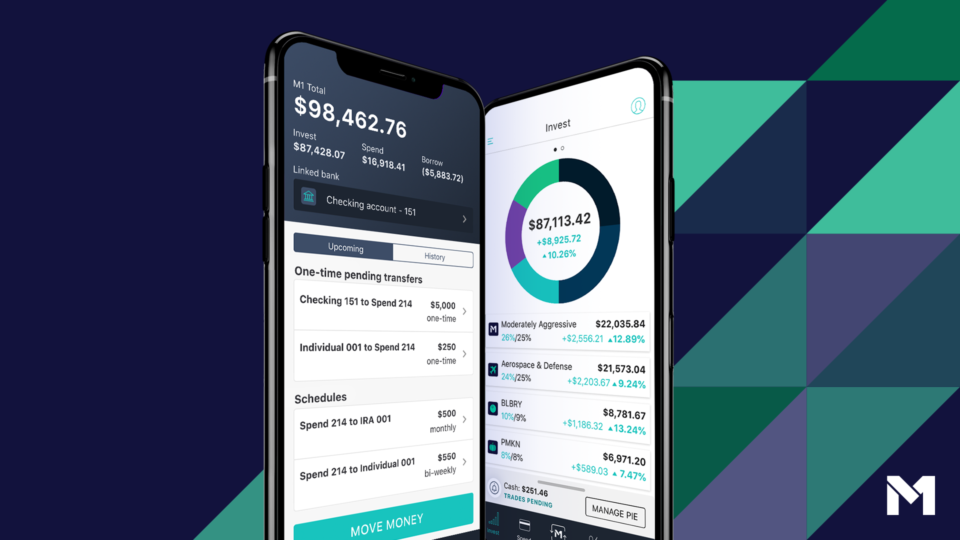

2. M1 Finance

M1 Finance has been one of the favorite platforms of advanced and intermediate traders alike. The platform isn’t just for day trading and swing trading, it is great for longterm investing and it allows you to invest using Traditional, Roth, and Rollover individual retirement accounts (IRAs).

Pros:

- No management or commissions fees

- You can invest in fractional shares.

- Automatic dividend reinvestment.

- Cash balances are FDIC-insured up to $250,000.

- Securities are SPIC-insured up to $500,000.

Cons:

- No tax-loss harvesting.

- Not as beginner friendly as other platforms.

- Can’t invest in mutual funds.

Start Investing With M1 Finance Today!

3. TD Ameritrade

TD Ameritrade is one of the biggest names when it comes to online platforms that provide services to online brokers. There are several platforms that you can choose from – ranging from their basic website to the intricate ones designed for very active online traders.

Pros:

- Extensive numbers of available resources and updated news to keep you in the loop of online trading.

- It provides a wider variety of asset classes to help novice investors settle in easily.

- Additional support channels such as WeChat, Facebook Messenger and Twitter.

- Commission on ETF trades and stock is $0 as of October 2019.

Cons:

- Since it provides multiple features, users may have to utilize more than one trading system.

- Some users may find it hard to find the tools that they want.

- With tons of content and tools available on their website, you may need to spend more time finding a particular item.

- Though they have eliminated base trading commissions on ETFs, equities and options for U.S.-based customers, their margin interest rates still remain high.

Start Investing With TD Ameritrade Today!

4. Charles Schwab

Founded in 1971, Charles Schwab has gone a long way into becoming one of the biggest US-based discount brokers. With its long track record and banking background, many investors feel safe and confident using this online platform.

Pros:

- High-quality research, including detailed fundamental data and trading ideas.

- It has low trading fees and no inactivity fee.

- The customer support team provides answers and solutions in a timely manner.

- Native mobile apps and mobile web platforms offer the same functionality.

Cons:

- You may need to use different platforms to access other features.

- Geared towards utilizing a financial investor.

- Low interest paid on the cash balance.

Start Investing With Charles Schwab Today!

5. Zacks Trade

Zacks Trade is an online trading platform that caters more towards active day-traders. Just like other investment platforms, Zacks Trade also offers the ability to buy stocks and bonds. What sets them apart is its users access to two incredibly in-depth and complex platforms. In addition, this enables experienced traders to make more aggressive trades.

Pros:

- Zacks Trade has cheaper trading commissions compared to other online trading platforms.

- Investors have access to 26 news reports and research for free, including Zacks Investment Research.>

- You can easily trade securities on over 90 different exchanges in 19 countries.

- It offers two tools – downloadable ZacksTrade Pro and the web-based ZacksTrader.

- Aside from their phone and chat lines, Zacks Trade also provides its users access to a broker for free.

Cons:

- May not be the best platform for novice traders.

- The platform and website are slow and clunky.

Start Investing With Zacks Trade Today!

6. Fidelity Investments

Fidelity is one of the world’s largest investment brokerages today, with $0 trading commissions and zero-fee index funds. For investors who want to be fully hands-on with their portfolio, Fidelity provides comprehensive self-directed investment tools. On the other hand, they also provide portfolio advisory services, a dedicated Robo-advisor platform, and wealth management to those who want their portfolios professionally managed.

Pros:

- They offer one of the lowest fees and commissions which is highly beneficial for high-frequency traders.

- Fidelity provides a wide variety of educational resources and trading tools.

- Easy accessibility with around 140 branch locations in and around most major metropolitan areas in the US.

- Users have access to self-employed retirement plans such as SIMPLE IRAs and SEP and small business 401(k) plans.

Cons:

- They have a high fee structure for portfolio advisory services and wealth management.

- High annual fee side for Fidelity Go Robo-advisor.

Start Investing With Fidelity Today!

7. Webull

Webull is a solid choice when it comes to online trading platforms. It provides 100% commission-free stock, ETFs, cryptocurrency trades, and options. And what’s even better? They have a $0 account minimum too. This platform is perfect if you want to trade without having to pay any commissions or fees (and who really wants to pay commission ?).

Pros:

- The platform is very easy to use which makes it suitable for beginners.

- No commission charges for trading ETFs, stocks, cryptocurrency or options.

Cons

- It provides a bare-bones trading experience that may not be favorable for investors who want a robust trading platform.

- Research tools and educational resources are severely lacking.

- Users can hardly customize or personalize the experience of both the app and website.

Start Investing With Webull Today!

8. E*Trade

E*Trade is one of the original online trading platforms and therefore one of the most popular. The platform is not only user-friendly but it also provides tools and resources needed for investors to make better investment decisions. Ironically, even though it was one of the first online trading platforms that forced major changes in fee structure for the industry, it is no longer the cheapest option out there.

There is no minimum amount needed to sign up with E*Trade. There is no basic management fees and annual charges either.

Pros:

- Wide selections of available tools and resources.

- Low costs and fees.

- Phone support is available 24/7. They also have local branches throughout the country.

- Two platforms are available – E*Trade Web and E*Trade mobile app.

Cons:

- Above-average margin interest rates.

Start Investing With E-Trade Today!

9. Ally Invest

Ally Invest ranks high amongst the list of stockbrokers for both new and seasoned traders. What makes this platform appealing? Aside from its zero required minimum and commissions, Ally Invest also offers a great selection of trading features. In addition, they take pride in their excellent customer service and online banking.

Although it is relatively new to the industry, Ally Invest has clearly made a splash. They now have more than 250,000 customer accounts and hold more than $4.7 billion in assets.

Pros:

- Free trading commissions for ETF trades, options, and online stock.

- Zero account balance minimum.

- The platform provides a customizable dashboard and real-time streaming quotes and data. In addition, users have access to all of the broker’s tools.

- High-quality investing research and tools.

Cons:

- They don’t have any physical branches.

- Transfer of funds into your account could take 5-10 business days.

Start Investing With Ally Today!

10. DiversityFund

![]()

Want to invest like a millionaire? That is what DiversityFund is offering, by allowing you diversify your investments beyond stocks and bonds and into Commercial Real Estate (alternative assets).

DiversyFund is dedicated to creating wealth for me and you, AKA “the everyday investor.” How do they help you invest like a millionaire? Simple. They help people ). And they do this because they want everyone to be able to achieve financial freedom.

Pros:

- No fees.

- Low minimum ($500) to open an account.

- Exposure to Commercial Real Estate investments.

Cons:

- This platform is not for seasoned real estate investors.

- Real estate investing is not for people looking to day trade.

Start Investing With DiversityFund Today!

11. RocketDollar

This platform has made alternative investments easier and more accessible to the average Joe. RocketDollar attracts investors looking for non-traditional assets. As such, the biggest draw of RocketDollar is that they offer solo 401(k) and self-directed IRA plans, so you can put all those non-traditional assets in your tax-advantaged retirement account.

Pros:

- No minimum investment required.

- Access to non-traditional asset classes like private equity, peer to peer lending, real estate, cryptocurrencies, and more.

- Easy to use platform.

- Low $15 monthly fee.

- Solo 401(k) and self-directed IRA plans.

Cons:

- One time set up fee of $360.

- Educational resources available may not satisfy the needs of novice investors.

- No mobile app available.

Start Investing With RocketDollar Today!

Our Verdict On The Best Online Trading Platforms

If you’re a beginner who is just starting out, we highly recommend Public. From fractional investing to commission free trading to a very social and helpful community, the platform really is a great option.

If you don’t think you can swing a minimum investment, you should looking into an app like Acorns might be worth it for you. Starting to invest is key, even if you can only invest your spare change.

As for our recommendation for the best online trading platform, M1 Finance takes the win. Their top of the line trading platform, excellent resources, and aggressive pricing structure make them our pick. In addition, if you’re just starting with your online trading journey or are already an expert, M1 Finance has something for you.