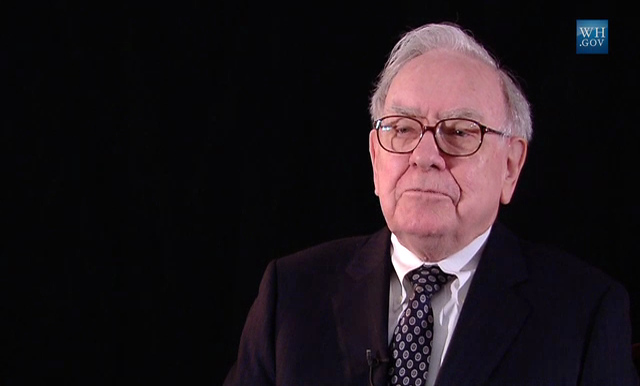

Warren Buffett Says He Wouldn’t Buy All The Bitcoin In The World For $25

Warren Buffett won’t be investing in bitcoin anytime soon. In fact, you could practically gift the legendary investor cryptocurrency and he wouldn’t want it.

Buffett’s repudiation of bitcoin came during 2022’s Berkshire Hathaway annual shareholders meeting.

“If you said for a 1% interest in all the farmland in the United States, pay our group $25 billion, I’ll write you a check this afternoon,” Buffett said at the meeting, according to Motley Fool. “(For) $25 billion I now own 1% of the farmland. (If) you offer me 1% of all the apartment houses in the country, and you want another $25 billion, I’ll write you a check; it’s very simple.”

Buffett then made a shocking proclamation about cryptocurrency, “Now, if you told me you own all of the bitcoin in the world and you offered it to me for $25, I wouldn’t take it because what would I do with it?”

“I’d have to sell it back to you one way or another,” he explained. “It isn’t going to do anything. The apartments are going to produce rent, and the farms are going to produce food.”

Buffett declared that bitcoin doesn’t produce anything and claimed that cryptocurrency has “magic to it,” but not in a complimentary way.

“Whether it goes up or down in the next year, or five or 10 years, I don’t know. But the one thing I’m pretty sure of is that it doesn’t produce anything,” Buffett skeptically said. “It’s got a magic to it and people have attached magic to lots of things.”

“Assets, to have value, have to deliver something to somebody. And there’s only one currency that’s accepted. You can come up with all kinds of things — we can put up Berkshire coins… but in the end, this is money,” Buffett said as he held up a $20 bill, according to CNBC. “And there’s no reason in the world why the United States government … is going to let Berkshire money replace theirs.”

Buffett’s longtime Berkshire business partner Charlie Munger also knocked bitcoin at the annual shareholders meeting.

“In my life, I try and avoid things that are stupid and evil and make me look bad in comparison to somebody else – and bitcoin does all three,” Munger declared. “In the first place, it’s stupid because it’s still likely to go to zero. It’s evil because it undermines the Federal Reserve System … and third, it makes us look foolish compared to the Communist leader in China. He was smart enough to ban bitcoin in China.”

This isn’t the first time that Buffett has railed against crypto.

In May 2018, Buffett said bitcoin is “probably rat poison squared.”

At the same time, Munger also slammed bitcoin, “I like cryptocurrencies a lot less than you do. To me, it’s just dementia. It’s like somebody else is trading turds and you decide you can’t be left out.”

In January 2018, the Berkshire Hathaway CEO proclaimed, “In terms of cryptocurrencies, generally, I can say with almost certainty that they will come to a bad ending. When it happens or how or anything else, I don’t know. If I could buy a five-year put on every one of the cryptocurrencies, I’d be glad to do it but I would never short a dime’s worth.”

In October 2017, Buffett again criticized the popular cryptocurrency, “You can’t value bitcoin because it’s not a value-producing asset.”

As of Wednesday, the price of bitcoin was slightly above $29,0000 – far lower than the high that hit nearly $69,000 in November 2021.