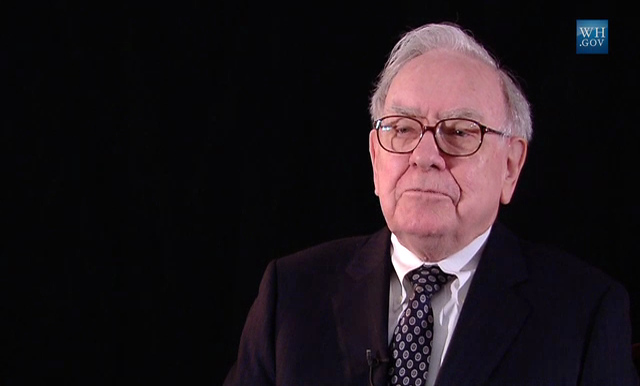

Warren Buffett Calls Inflation A ‘Gigantic Corporate Tapeworm,’ Reveals Best Businesses To Own To Counter It

The personal consumption expenditures price index – the Federal Reserve’s preferred measure of inflation – jumped to a 4.4% increase over last year (above the Fed’s preferred target of 2%), this is the fastest pace in 30 years.

Federal Reserve Chairman Jerome Powell warned that the surging inflation may last well into 2022.

“The timing of that is highly uncertain, but certainly we should see inflation moving down by the second or third quarter,” Powell said on Wednesday.

“Particularly people who are living paycheck-to-paycheck are seeing higher grocery costs, higher gasoline costs, when the winter comes higher heating costs for their homes,” Powell added. “We understand completely what they’re going through and we will use our tools over time to make sure that that doesn’t become a permanent feature of life.”

Warren Buffett Warns About Inflation Dangers

Warren Buffett has sounded the alarm on the dangers of inflation in the past, and called it a “gigantic corporate tapeworm.”

“Inflation takes us through the looking glass into the upside-down world of Alice in Wonderland,” Buffett said.

“Inflation acts as a gigantic corporate tapeworm,” the Berkshire Hathaway CEO continued. “That tapeworm preemptively consumes its requisite daily diet of investment dollars regardless of the health of the host organism. Regardless of a company’s profits, it has to spend more on receivables, inventory, and fixed assets to simply equal the unit volume of the previous year.”

“The less prosperous the enterprise, the greater the proportion of available sustenance claimed by the tapeworm,” Buffett explained. “The tapeworm of inflation simply cleans the plate.”

Warren Buffett Says Inflation Is A ‘Tax On Capital’

Buffett defined inflation as a “tax on capital.”

“High rates of inflation create a tax on capital that makes much corporate investment unwise – at least if measured by the criterion of a positive real investment return to owners,” the Oracle of Omaha said.

“This ‘hurdle rate’ the return on equity that must be achieved by a corporation in order to produce any real return for its individual owners — has increased dramatically in recent years,” he continued. “The average tax paying investor is now running up a down escalator whose pace has accelerated to the point where his upward progress is nil.”

“A business earning 20% on capital can produce a negative real return for its owners under inflationary conditions not much more severe than presently prevail.”

Buffett addressed rising prices in the 1979 Berkshire Hathaway letter to shareholders:

The inflation rate plus the percentage of capital that must be paid by the owner to transfer into his own pocket the annual earnings achieved by the business (i.e., ordinary income tax on dividends and capital gains tax on retained earnings) — can be thought of as an ‘investor’s misery index.’ When this index exceeds the rate of return earned on equity by the business, the investor’s purchasing power (real capital) shrinks even though he consumes nothing at all. We have no corporate solution to this problem; high inflation rates will not help us earn higher rates of return on equity.

Warren Buffett Reveals The Best Businesses To Own During Times Of Inflation

To counter inflation, Buffett advises investors to seek out businesses that can handle high inflation based on two aspects.

Companies that, through design or accident, have purchased only businesses that are particularly well adapted to an inflationary environment. Such favored business must have two characteristics: (1) an ability to increase prices rather easily (even when product demand is flat and capacity is not fully utilized) without fear of significant loss of either market share or unit volume, and (2) an ability to accommodate large dollar volume increases in business (often produced more by inflation than by real growth) with only minor additional investment of capital. Managers of ordinary ability, focusing solely on acquisition possibilities meeting these tests, have achieved excellent results in recent decades. However, very few enterprises possess both characteristics, and competition to buy those that do has now become fierce to the point of being self-defeating.

In the 2015 letter, Warren Buffett provided more insight on what businesses to invest in.

“The best businesses during inflation are the businesses that you buy once and then you don’t have to keep making capital investments subsequently,” Buffett stated. “Any business with heavy capital investment tends to be a poor business to be in in inflation and often it’s a poor business to be in generally.”

In his 1980 Berkshire Hathaway letter to shareholders, Buffett wrote, “The average tax-paying investor is now running up a down escalator whose pace has accelerated to the point where his upward progress is nil.”

Buffett gave this advice on how to deal with inflation: “The chances for very low rates of inflation are not nil. Inflation is man-made; perhaps it can be man-mastered. The threat which alarms us may also alarm legislators and other powerful groups, prompting some appropriate response.”