How the Rich Stay Rich: 12 Smart Financial Habits of the Wealthy

If you’re wondering how the ultra-rich are able to maintain and grow their fortunes over time, you’ve come to the right place. By diligently following financial habits and strategies that allow them to live large, the world’s elite are able to make their money work for them. (Of course, they’re also able to casually blow money on some pretty insane things.) Here are 12 strategies the ultra-rich use to stay rich and become even richer.

1. Living Below Their Means

Sure, some people with serious cash flow spend their money as quickly as they earn it, even buying outrageous gifts for themselves. But others often spend less than they earn, regardless of their wealth. Instead of overspending on frivolous luxuries, they prioritize financial security. By living below their means, they also build a strong financial foundation that allows them to take advantage of opportunities without jeopardizing their wealth.

2. Paying Off Balances in Full To Avoid Interest

Wealthy folks tend to avoid debt by paying off credit card balances in full each month. This strategy helps them avoid high-interest charges, which can compound quickly. By doing this, they’re able to keep their financial costs low, maintain excellent credit, and ensure that their money is always working for them, rather than against them.

3. Investing Smartly

It seems like a no-brainer: The ultra-rich know that wealth grows through smart, diversified investments. They typically invest in a wide range of assets, including stocks, real estate, bonds, and private equity. Having a diverse portfolio helps reduce risk while maximizing returns. In short, even if one investment underperforms, others can pick up the slack to generate significant dough.

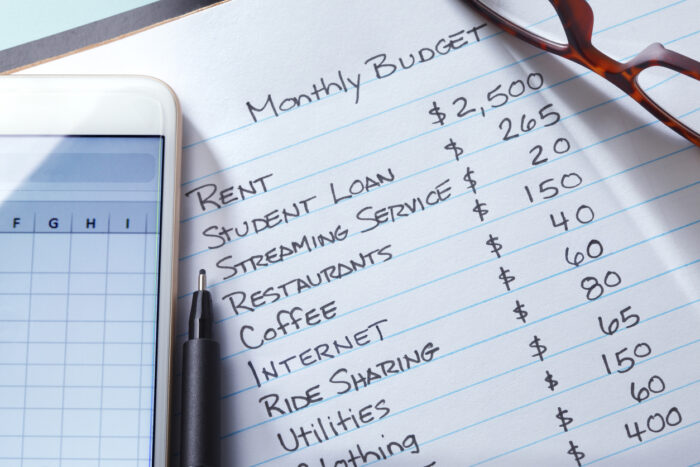

4. Sticking to a Budget

Even with their vast wealth, many savvy rich folks still adhere to a strict budget. This means allocating their income carefully to ensure that they only spend what is necessary and invest the rest. A well-structured budget helps them track expenses, prevent overspending, and keep their finances organized, while also leaving room for future opportunities. Wonder what it’s like to have millions of dollars to budget.

5. Reinvesting Profits

Instead of blowing their Benjamins on personal luxuries, the ultra-rich often reinvest them to fuel further growth and avoid common financial pitfalls. Whether it’s income from a business or returns from investments, they funnel those earnings back into ventures or markets that can generate even more wealth through compound interest and other financial strategies.

6. Hiring Financial Advisors

The wealthy rarely go it alone when it comes to managing their finances. They hire top-tier financial advisors to help them make informed decisions about investments, taxes, and estate planning. These professionals bring expertise in complex financial markets and strategies to help their clients minimize risks and capitalize on lucrative investment opportunities.

7. Rubbing Shoulders With the Elite

Ah, good ol’ networking. Rich people tend to network with others in their circle to share insights, opportunities, and strategic partnerships. By surrounding themselves with like-minded individuals, they gain access to exclusive investment opportunities, business deals, and financial ventures that may not be available to the general public.

8. Minimizing Taxes

While the rich do pay taxes, they often use legal strategies to minimize their tax burden. This means taking advantage of tax deductions, credits, and loopholes to reduce the amount they owe to the Internal Revenue Service (IRS). By keeping more of their income, they can reinvest it or save it, allowing them to build even more wealth.

9. Creating Multiple Streams of Income

The ultra-wealthy never rely on just one source of income. In addition to their primary business or career, they generate income from other investments like real estate, dividends, crypto, and passive income streams. This diversified approach ensures that if one income stream declines, others can continue to generate wealth. Having multiple income streams also provides them with greater financial security in case one source of income isn’t doing so hot.

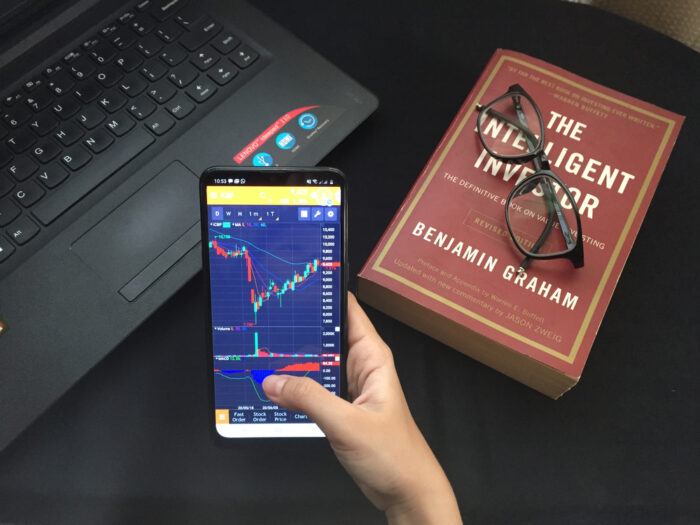

10. Educating Themselves on Financial Matters

True, reading about getting rich isn’t necessarily going to help you actually get rich, but many wealthy folks take the time to stay educated on the latest financial trends and movements. They may be well read on financial books, attend seminars, and engage with experts to continuously improve their knowledge of wealth-building strategies. This allows them to spot emerging opportunities before they become mainstream, giving them a competitive edge.

11. Taking Calculated Risks

The ultra-rich understand that risk is an inherent part of wealth-building, but in order to protect their assets, they’ll take calculated risks instead of reckless ones (a tamer version of “No risk, no reward.”). This mean they carefully analyze potential rewards and losses before making a decision. By balancing risk factors, they can increase their chances of success while minimizing potential financial losses.

12. Building and Preserving Assets

Rather than focusing on depreciating “play things” like cars, yachts, or expensive electronics, the wealthy invest in assets that appreciate over time, such as real estate, stocks, and businesses. They’re laser-focused on building a portfolio of assets that will increase in value and generate income over time. By acquiring and preserving these assets, the rich create a financial legacy that can be passed down to future generations.