Acorns Announces Crypto Investing Is Coming To The App

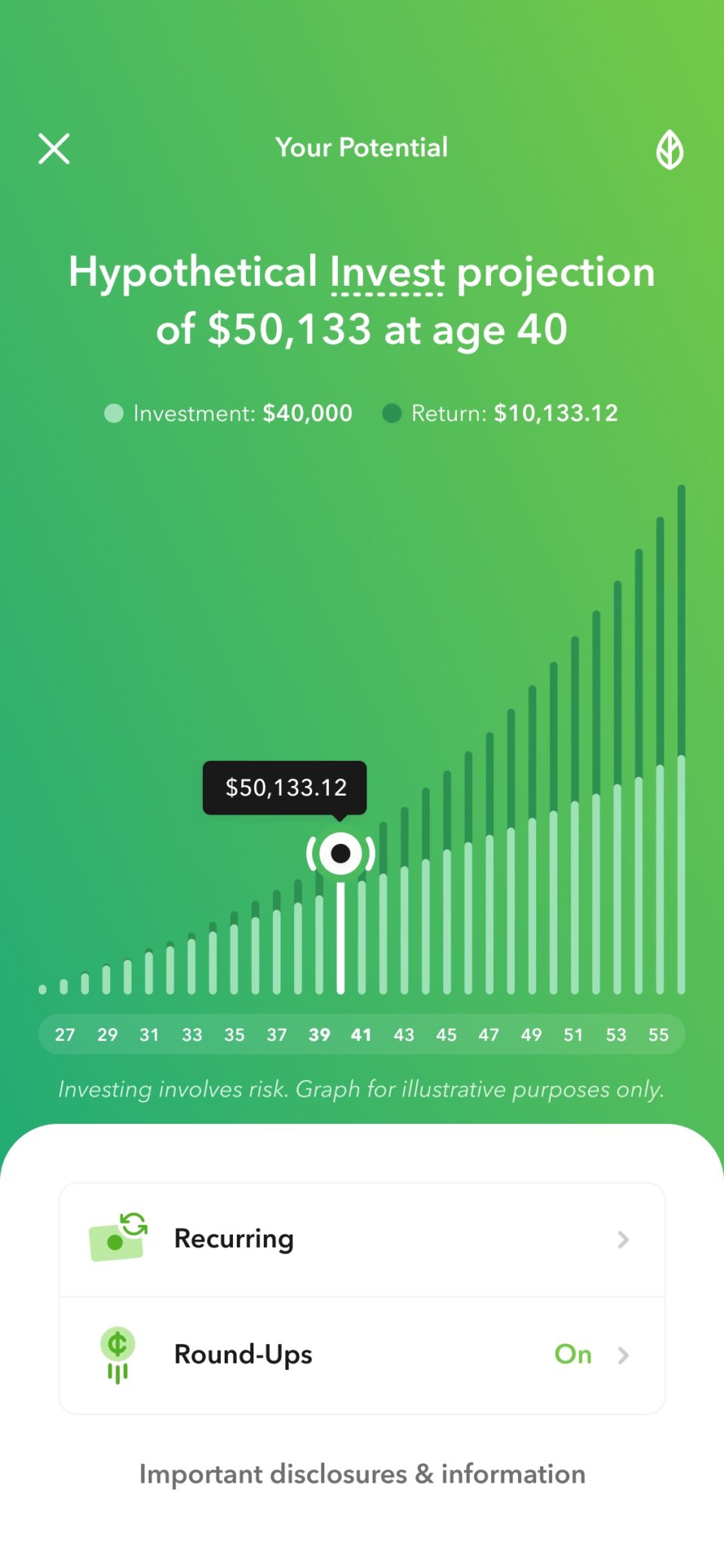

A couple of years ago, I started using the Acorns to get serious about saving for the future. I’m a big fan of the set-it-and-forget-it capabilities that come with the service, with credit card round-ups and automatic withdraw to my aggressive portfolio.

The investing app claims 4 million subscribers who have invested more than $9.6 billion since its inception in 2012. Clearly, it struck a nerve with a certain kind of millennial and Gen-Z investor.

Get $5 When You Sign Up For Acorns Now

In the meantime, the company is preparing for an IPO after merging with a special purpose acquisition company, Pioneer Merger Corp.

The Acorns IPO is expected to move forward in “the second half of 2021”, trading under the symbol OAKS on the NASDAQ. One of the more exciting pieces of news in the SEC filing is a program designed for Acorns customers to own shares in the company as it hits the public markets. According to the filing, Noah Kerner, Acorns Chief Executive Officer, plans to contribute “10% of his personal ownership in Acorns to fund a novel program giving shares to eligible customers. Pioneer’s sponsor is also planning to give 10% of its ownership in Acorns to this same program.”

“Our loyal customers have gotten us here,” said Kerner. “They’ve earned a right to become owners alongside us, and help us grow together into the mighty oak that Acorns was meant to become. To that end, we intend to introduce our share rewards program that will allow eligible customers to own a piece of the company and an even greater piece as they invite others to start the path toward financial wellness.”

Acorns Says Crypto Investing Is Coming

As the company ramps up for an IPO, some big changes appear to be coming up to Acorns.

In announcing the hiring of the company’s new President, former Amazon executive David Hijirida, Acorns also announced that crypto investing will soon be coming to the service. He also announced that users will be able to further customize their portfolios – a marked changed from the five investor portfolios currently on the app.

Kerner told CNBC, “We are going to let people customize their portfolios and add individual equities and crypto into a slice of their diversified portfolios, much the way a money manager would advise you to behave.”

The goal is an app investing experience that’s more geared towards long-term investing behaviors vs. the current experience of an app like Robinhood or WeBull.

“Everything Acorns does is about long-term saving and investing for the everyday consumer,” Kerner explains to CNBC. “It’s why our subscription model is so important because it decouples the business from behaviors that aren’t necessarily customer-aligned, like driving trading or driving spending or driving borrowing.”

I think the way they said they would set it up basically takes the standard portfolios (aggressive, moderate, etc) and takes a certain percentage and allows you to manage THAT percentage. So now the aggressive portfolio has 4 components set at a predetermined percentage. This would become 5 components and allow you to handle the 5th.

I guess Acorns users like myself will see how these new products and services rollout. The new moves seem designed for the user to feel more in control of their investments rather than just being passively managed.

It’s an exciting time to watch the service evolve.

Get $5 When You Sign Up For Acorns Now