This Is The Average Net Worth Of People Your Age, According To The Latest Data

Society should embrace keeping up with the Joneses, but from a net worth standpoint instead of just trying to own a meaningless material possessions. After all, that new set of golf clubs or that new $2,000 purse, while nice, isn’t going to get most people any closer to retirement. Unless, of course, you’re buying them to flip as a side hustle!

What needs to be taken into consideration with the Average Net Worth By Age data below is that all of these averages factor in individuals with the highest net worths. Using that net worth data skews the Average Net Worth numbers for each age range. In fact, when you add the highest net worth individuals into the average net worth for all American households, you get an average household net worth of over $600,000. We all know that is not true.

Even with the wealthiest people in America skewing the data slightly higher, these numbers are still great to look at and not completely untouchable if you are earning a decent salary and you have your expenses under control.

This Is The Average Net Worth Of People Your Age

Under 35

- Median net worth: $13,900

- Average net worth: $76,300

35-44

- Median net worth: $91,300

- Average net worth: $436,200

45-54

- Median net worth: $168,600

- Average net worth: $833,200

55-64

- Median net worth: $212,500

- Average net worth: $1,175,900

65-74

- Median net worth: $266,400

- Average net worth: $1,217,700

Over 75

- Median net worth: $254,800

- Average net worth: $977,600

So how do these numbers stack up with where your net worth or retirement savings should be by age?

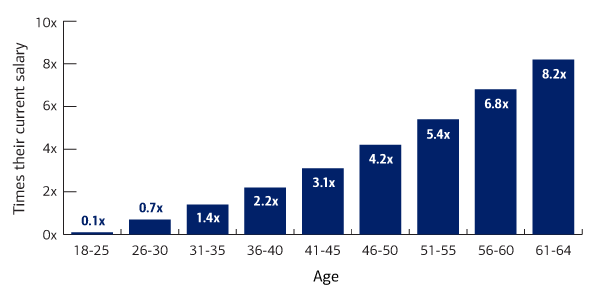

Well, that exact number is tough to pin down because everyone’s income and expenses are different. But as you can see on this chart from Merrill Lynch, your minimum net worth at every age should be based on your annual salary. So if you make $200,000 per year at age 40, you should aim to have no less than $400,000 in net worth.

Remember, progress is progress. While we all aspire to be in the top 1% and retire early, if you keep saving and investing consistently, you should be exactly where you want to be by the time you’re ready to retire.

How Do You Calculate Your Net Worth?

Calculating your net worth can be a daunting task, but it’s well worth the effort.

The first step to calculating your net worth is to add up all of your assets. This includes:

- Cash,

- Investments

- Real estate

- Vehicles

- Other items of value that you own.

Once you have totaled your assets, subtract any liabilities from the total. This includes:

- Mortgage balances

- Credit card debt,

- Car loans

- Student loans.

- Other debt you owe.

The difference between your assets and liabilities is your net worth.

You can also use a balance sheet to track your net worth. It will also help you identify areas where you can improve, such as eliminating debt or investing more money.

34-Year-Old With $1M Net Worth Explains 4 Money Habits To Start Now

Whether the goal is to get in shape or get your finances in order, developing habits is the key to success.

When it comes to managing money, having sound financial habits can fast track a person to save money, get out of debt, and live the life of their choosing.

Mandi Woodruff-Santos is a personal finance expert, award-winning journalist, content strategist, and co-host of the podcast Brown Ambition. Woodruff-Santos recently wrote an article for CNBC highlighting the seven strategies she used to build her wealth.

At 34, Woodruff-Santos has a net worth of more than $700,000, and she’s currently on track to build a net worth of $1M by her 40th birthday. She breaks down the seven best money habits to adopt before turning 40. While all seven suggestions are essential, here are the four most crucial habits to start now.

1. Avoid lifestyle inflation: It almost feels like a trap. A person starts making more money and feels pressure to upgrade their lifestyle to match their income. Woodruff-Santos explains why this is a bad idea.

“When you’re young, every pay raise feels like an excuse to get a bigger apartment with more amenities or take more vacations. But I was intentional about keeping my living expenses low. I set a rule to not spend more than 30% of my monthly pay on rent, which meant still having roommates even though I could afford to live alone.

And when we needed to save money for our wedding, my then-fiancé and I moved into his parent’s house for six months. It wasn’t easy, but we were able to save $11,000 for our big day.”

2. Don’t be too rigid: You might assume that the stricter you are with spending money, the quicker you’ll obtain personal wealth. While this is true, being too strict with a budget could cause internal turmoil that ultimately leads to failure.

“My first budgeting plan was very aggressive; I wanted to save as much money as possible. But I constantly ended up disappointing myself by spending on things like dining out and holiday gifts. I ultimately realized that having a rigid budget plan wasn’t doing me any good and that I was feeling guilty for purchases that I didn’t consider irresponsible at all.

So I instead focused on automating all my bill payments, including any investment and savings contributions. That way, every dollar that went into my bank account on payday was a dollar I knew I could afford to spend.”

3. Always look for better jobs: You might love your job, and that’s fantastic, but are you making as much money as possible? Is there room for growth? These are just some questions to ask yourself, especially if you want to earn as much money as possible and build personal wealth.

“Nearly every time I quit a job for a new one, I was able to increase my salary by at least 30%,” writes Woodruff-Santos. “At 24, I was earning $45,000 a year, so a 10% investing rate meant putting about $4,500 into my 401(k). But five years and a few job changes later, my income was well over $150,000, and I was able to max out my 401(k) for the first time.”

Even if you’re happy with your job and salary, it never hurts to look around once in a while for better opportunities and more money.

4. Save and invest simultaneously: This was suggestion #1 on Woodruff-Santos’s list of the best money habits to start before 40 is to save money and invest money simultaneously.

She writes:

“As a recession-era graduate, I was nervous about investing my money, for fear of losing it to another market crash. But I realized that even though keeping all my money in a savings account felt ‘safer,’ it would stifle my chances of growing wealth faster.”

The writer and podcaster devised a plan that would allow her to save, invest and still sleep soundly at night. She set up automatic transfers for each pay period — 10% of my paycheck towards my employer-sponsored 401(k) and another 10% into a high-yield savings account.

How Can You Grow Your Wealth Faster?

If you feel behind on your wealth accumulation or you just want to find a way to speed up your path to financial freedom, there are a lot of things you can do. You can seek out higher returns through alternative investments like real estate crowdfunding or owning fractional shares of fine art. If you don’t have a ton of extra cash to invest, you can also take smaller steps by simply using an app like Acorns to invest your spare change.