TikToker Explains How Tax Brackets Actually Work In Under One-Minute

Most people have heard of tax brackets, but do you really understand how they work? Understanding tax brackets is an important part of one’s personal financial literacy, especially when calculating one’s post-tax income.

Even so, a few things in life are more certain – and confusing – than taxes.

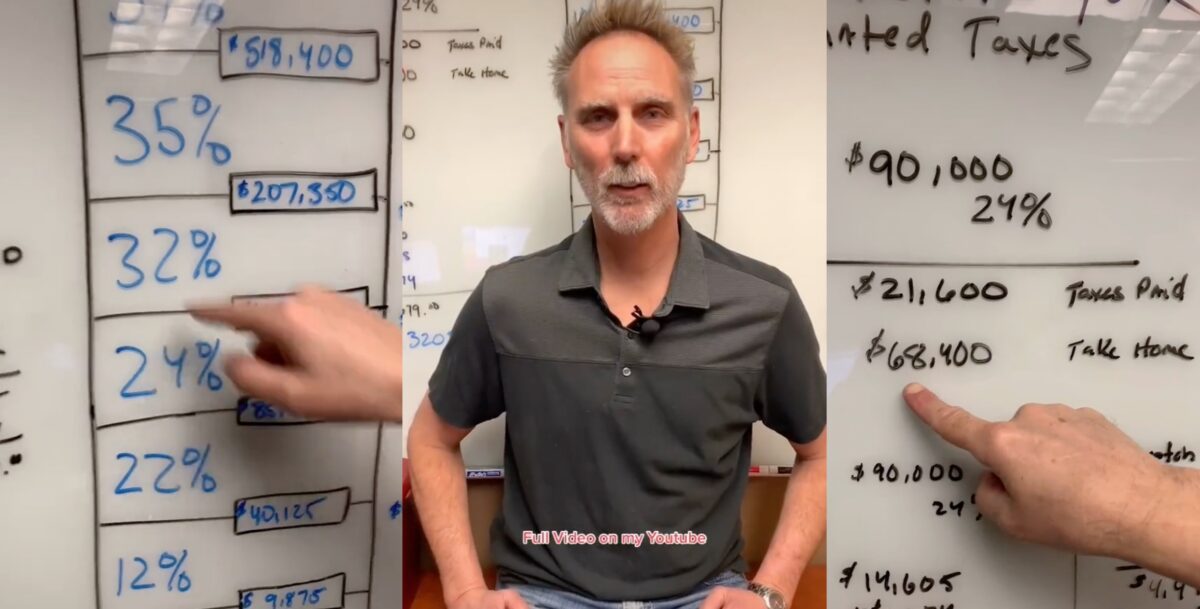

Scott McLaine at BrightWealth® Financial Services put together a helpful TikTok video explaining how tax brackets work. His thesis is simple: Understanding the tax bracket system is important for calculating the amount you owe in federal income taxes and figuring out how to reduce your income taxes with a meaningful strategy in the future.

“People have the misconception that taxes are calculated based on what you make as a whole, when in fact taxes are based on a tier system (bracket system). In this video. I will explain how that works…”

How do tax brackets work?

Tax brackets work by taxing portions of your income at different rates.

The U.S. federal income tax is a progressive tax system, meaning that the more money you make, the higher your tax rate.

Each tax bracket has a range of taxable income and a corresponding tax rate. The lowest tax rate is 10%, and the highest tax rate is 37%. Income earned within each bracket is taxed at the corresponding rate.

Tax brackets show you the tax rate that you have to pay on each portion of your income. The key word here is each portion – As TurboTax explains, If you are single in the United States, the lowest tax rate of 10% is applied to the first $10,275 of your income in 2022. From there, another chunk of your income is then taxed at 12%, and so on, up to the top of your taxable income.

The goal of tax brackets is to ensure a level playing field for all taxpayers, regardless of income. This is why people with higher incomes pay higher taxes.

It’s not as simple as a percent associated with your gross taxable income, as BrightWealth explains.

Here’s his easy-to-understand video:

Of course, there are a myriad of factors that come into consideration with taxes (IE: short and long term capital gains and losses), so remember to consult a professional in assessing a your own situation.

Not sure what Tax Bracket you’re in. Here are the 2022 and 2023 tax brackets

2022 Tax Brackets and Tax Rates (for tax filing in 2023)

Single

| If taxable income is over: | but not over: | the tax is: |

| $0 | $10,275 | 10% of the amount over $0 |

| $10,275 | $41,775 | $1,027.50 plus 12% of the amount over $10,275 |

| $41,775 | $89,075 | $4,807.50 plus 22% of the amount over $41,775 |

| $89,075 | $170,050 | $15,213.50 plus 24% of the amount over $89,075 |

| $170,050 | $215,950 | $34,647.50 plus 32% of the amount over $170,050 |

| $215,950 | $539,900 | $49,335.50 plus 35% of the amount over $215,950 |

| $539,900 | no limit | $162,718 plus 37% of the amount over $539,900 |

Married Filing Jointly or Qualifying Widow (Widower)

| If taxable income is over: | but not over: | the tax is: |

| $0 | $20,550 | 10% of the amount over $0 |

| $20,550 | $83,550 | $2,055 plus 12% of the amount over $20,550 |

| $83,550 | $178,150 | $9,615 plus 22% of the amount over $83,550 |

| $178,150 | $340,100 | $30,427 plus 24% of the amount over $178,150 |

| $340,100 | $431,900 | $69,295 plus 32% of the amount over $340,100 |

| $431,900 | $647,850 | $98,671 plus 35% of the amount over $431,900 |

| $647,850 | no limit | $174,235.50 plus 37 % of the amount over $647,850 |

Married Filing Separately

| If taxable income is over: | but not over: | the tax is: |

| $0 | $10,275 | 10% of the amount over $0 |

| $10,275 | $41,775 | $1027.50 plus 12% of the amount over $10,275 |

| $41,775 | $89,075 | $4807.50 plus 22% of the amount over $41,775 |

| $89,075 | $170,050 | $15,213.50 plus 24% of the amount over $89,075 |

| $170,050 | $215,950 | $34,647.50 plus 32% of the amount over $170,050 |

| $215,950 | $323,925 | $49,335.50 plus 35% of the amount over $215,950 |

| $323,925 | no limit | $87,126.75 plus 37% of the amount over $323,925 |

Head of Household

| If taxable income is over: | but not over: | the tax is: |

| $0 | $14,650 | 10% of the amount over $0 |

| $14,650 | $55,900 | $1,465 plus 12% of the amount over $14,650 |

| $55,900 | $89,050 | $6,415 plus 22% of the amount over $55,900 |

| $89,050 | $170,050 | $13,708 plus 24% of the amount over $89,050 |

| $170,050 | $215,950 | $33,148 plus 32% of the amount over $170,050 |

| $215,950 | $539,900 | $47,836 plus 35% of the amount over $215,950 |

| $539,900 | no limit | $161,218.50 plus 37% of the amount over $539,900 |

2023 Tax Brackets and Tax Rates (for tax filing in 2024)

Single

| If taxable income is over: | but not over: | the tax is: |

| $0 | $11,000 | 10% of the amount over $0 |

| $11,000 | $44,725 | $1,100 plus 12% of the amount over $11,000 |

| $44,725 | $95,375 | $5,147 plus 22% of the amount over $44,725 |

| $95,375 | $182,100 | $16,290 plus 24% of the amount over $95,375 |

| $182,100 | $231,250 | $37,104 plus 32% of the amount over $182,100 |

| $231,250 | $578,125 | $52,832 plus 35% of the amount over $231,250 |

| $578,125 | no limit | $174,238 plus 37% of the amount over $578,125 |

Married Filing Jointly or Qualifying Widow (Widower)

| If taxable income is over: | but not over: | the tax is: |

| $0 | $22,000 | 10% of the amount over $0 |

| $22,000 | $89,450 | $2,200 plus 12% of the amount over $22,000 |

| $89,450 | $190,750 | $10,294 plus 22% of the amount over $89,450 |

| $190,750 | $364,200 | $32,580 plus 24% of the amount over $190,750 |

| $364,200 | $462,500 | $74,208 plus 32% of the amount over $364,200 |

| $462,500 | $693,750 | $105,664 plus 35% of the amount over $462,500 |

| $693,750 | no limit | $186,601.50 plus 37 % of the amount over $693,750 |

Married Filing Separately

| If taxable income is over: | but not over: | the tax is: |

| $0 | $11,000 | 10% of the amount over $0 |

| $11,000 | $44,725 | $1,100 plus 12% of the amount over $11,000 |

| $44,725 | $95,375 | $5,147 plus 22% of the amount over $44,725 |

| $95,375 | $182,100 | $16,290 plus 24% of the amount over $95,375 |

| $182,100 | $231,250 | $37,104 plus 32% of the amount over $182,100 |

| $231,250 | $346,875 | $52,832 plus 35% of the amount over $231,250 |

| $346,875 | no limit | $93,300.75 plus 37% of the amount over $346,875 |

Head of Household

| If taxable income is over: | but not over: | the tax is: |

| $0 | $15,700 | 10% of the amount over $0 |

| $15,700 | $59,850 | $1,570 plus 12% of the amount over $15,700 |

| $59,850 | $95,350 | $6,868 plus 22% of the amount over $59,850 |

| $95,350 | $182,100 | $14,678 plus 24% of the amount over $95,350 |

| $182,100 | $231,250 | $35,498 plus 32% of the amount over $182,100 |

| $231,250 | $578,100 | $51,226 plus 35% of the amount over $231,250 |

| $578,100 | no limit | $172,623.50 plus 37% of the amount over $578,100 |