5 Biggest Warning Signs That You Will Run Out Of Money In Retirement

Retirement is the goal. It is the dream! But retirement could also turn out to be a nightmare if you don’t plan properly. And today we are going to go over the biggest warning signs that you will run out of money in retirement. Because just like what got you to retirement, it isn’t about how much you pay yourself in retirement, it’s about how much you keep.

These signs can apply to anyone and everyone who is looking to retire. Whether you are part of the F.I.R.E. (Financial Independence Retire Early) movement or you are closer to a typical retirement age (60-65) there are things you need to consider before you wake up one day wishing you worked longer or planned for retirement better.

5 Signs That You Will Run Out of Money in Retirement

Your Yearly Withdrawal Rate Is Too High

Before taking the plunge into retirement, you need to know exactly how much money you need to live. Don’t just pull a number out of thin air. Instead, try to make sure that your yearly retirement income is about 80% of your final pre-retirement salary. Meaning, if you’re earning $100,000 annually at time of retirement, you will need roughly $80,000 per year in retirement income (401K, passive income, side hustles) to continue having the same quality of life in retirement.

Obviously, determining your retirement income isn’t a one size fits all bucket. You might be more frugal than $80,000 per year, but extra cushion will ensure that your money lasts long after you expire. Or at least until you do.

The second part of this is your withdrawal rate. Most people tend to follow the 4% rule, which means you can safely withdrawal 4% from your investment portfolio for the entirety of your retirement. If $80K per year is the number you need to hit, then based on the 4% rule, you should only retire once you have hit $2,000,000 in retirement savings.

You Don’t Factor Taxes Into Your Expenses

Unless your money is coming completely from a Roth IRA (hooray for tax free gains!) then you need to account for capital gains taxes being taken out of what you pay yourself. One way to decrease the amount of tax you pay is to take blended distributions from an IRA and a traditional IRA or investment account. This way you can enjoy paying much lower taxes on your distributions.

One other strategy you can employ is to convert your traditional IRA into a Roth IRA in early retirement. This will provide you with more tax-free retirement income.

Your Spending Habits Change

Retirement brings with it more time to do things you love to do. But if your retirement doesn’t look similar to your pre-retirement life, then you need to take those changes into account. Are you planning to travel more in retirement? Do you want a country club membership? What about that car you always promised yourself? How about eating more dinners out?

One option is to eschew these expensive activities and instead look for low-cost forms of entertainment.

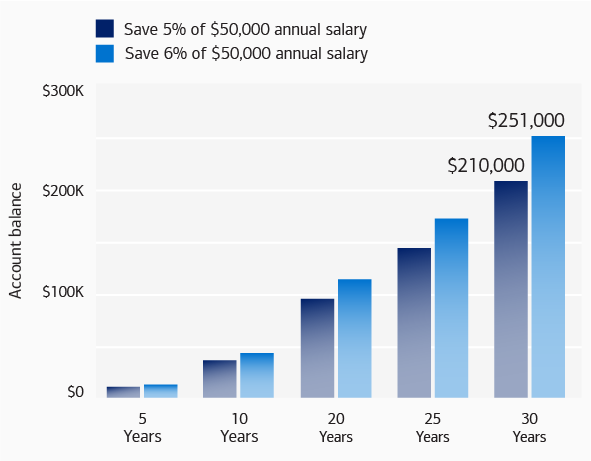

The other option is to plan better and save more so you can enjoy everything you want during retirement. After all, look at the huge difference 1% of extra investing can have over the course of 30 years. That extra money could help pay for all the things listed above.

But what if you don’t have 30 years? Then you need to prioritize the things that are important for you to enjoy your retirement, create a retirement budget and find a place to live where you can enjoy your golden years without the worry of ever running out of money.

Failure To Plan For High Healthcare Costs

Healthcare costs when you get older are like car insurance costs when you’re younger: EXPENSIVE!

In fact, according to the Fidelity Retiree Health Care Cost Estimate, an average retired couple age 65 in 2021 may need approximately $300,000 saved (after tax) to cover health care expenses in retirement.

That is a very large expense, and now you might understand why so many people delay retirement to stay on their company’s health insurance plan.

One tip that Fidelity suggests is to take advantage of a company HSA (health savings account) plan. “An HSA can help you save tax-efficiently for health care costs in retirement. You can save pretax dollars (and possibly collect employer contributions), which have the potential to grow and be withdrawn tax-free for federal and state tax purposes if used for qualified medical expenses.”

You Don’t Consider A 3% Yearly Inflation

If you’re not paying attention, inflation has a way of sneaking up on you. And it is easy to overlook when money is rolling in from your 9-5, side hustles, and other passive income streams. Life is good, and you don’t feel the pain of paying an extra $5 for a product or service that used to be cheaper.

But when you have a fixed income and you don’t plan on going back to work, inflation can eat away at your budget.

On average, the inflation rate in the U.S. has been 3.23% over the last century. If that trend continues, your $1,000,000 nest egg today will buy 40% less in 20 years than it can today.

Inflation is something to consider for anyone looking to retire, but definitely those who are part of the F.I.R.E. movement. It is great to retire early at 40 (again, THE DREAM!) but running out of money and having to go back into the workforce when you’re 60 doesn’t sound so fun.

Final Thoughts

These are just the biggest warning signs we see that should raise a red flag about if you will run out of money in retirement. Other unexpected life events could also have a major impact on your financial wellbeing in retirement. And unless you are ultra wealthy with a massive cushion, we suggest you embrace flexibility both in your short and long-term plan. Because retirement will be a lot less enjoyable if you are constantly under stress about how long your money will last.