13 Ways The Pandemic Has Changed Americans’ Financial Habits, According To New Data

Times they are a changin’. And thanks to Covid, they are changing faster than ever. From eCommerce gaining more ground on brick-and-mortar retailers to more and more Americans insisting on clinging to remote work, the pandemic has changed America. As expected, Covid has also caused Americans to change their financial habits. It’s caused everyone to reevaluate what matters most to them.

Recently, Personal Capital did a Financial Wellness survey to ascertain just how different people’s personal finances are in 2021. There is a lot to be gleaned from the report, but one thing stood out and that was people’s perspective on money (and possibly life) has changed in a big way. A wide-spread pandemic, months of lockdowns and financial uncertainty will do that to you.

Related: 4 Best Real Estate Crowdfunding Sites For Non-Accredited Investors

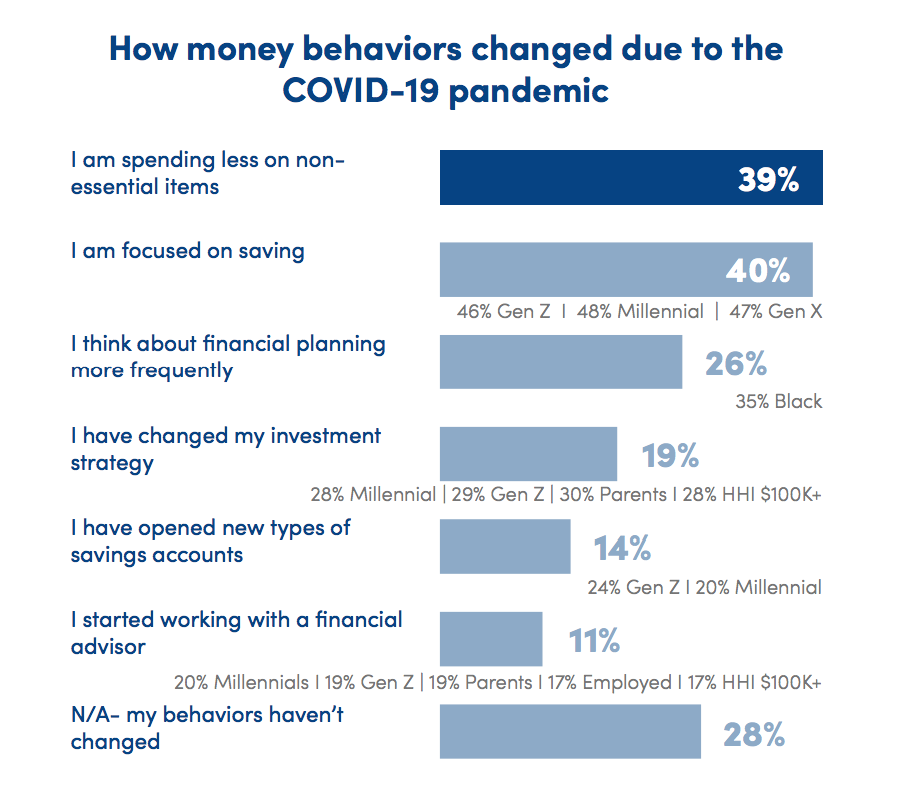

If you’re very focused on reaching financial independence — or early retirement — the results from the survey might come as a bit of a surprise. While the pandemic may have supercharged your desire to build more passive income streams, start a side hustle or invest more money in the stock market or alternative investments, it seems that for a lot of people, money has taken a backseat to living in the present and enjoying life.

With that, here are some results from the Personal Capital Financial Wellness Report.

13 Ways The Pandemic Has Changed Americans’ Financial Habits

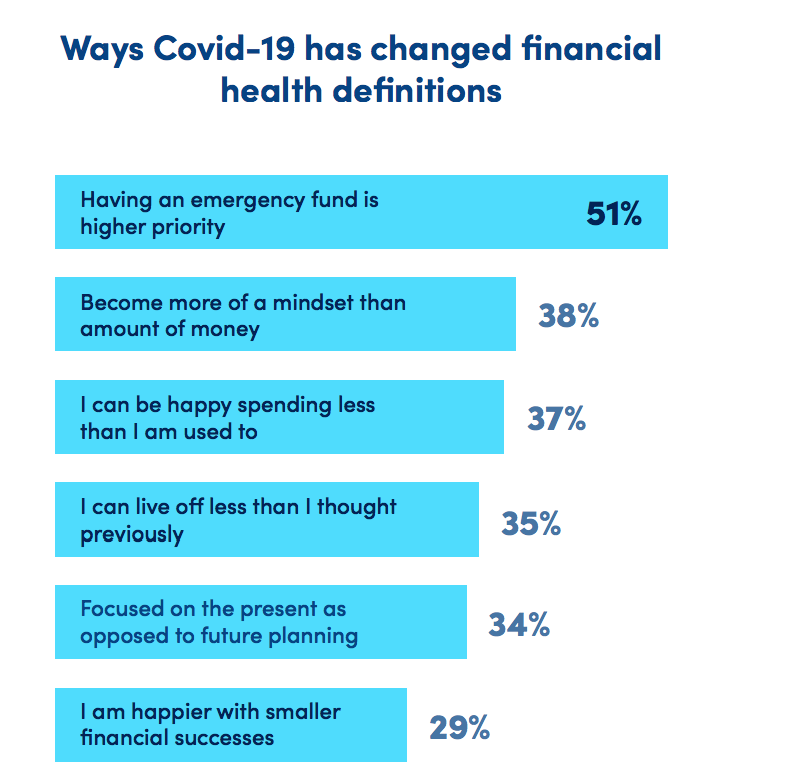

When talking about what financial health means, the shift in thinking here appears to be very clear. While most people agree that having an emergency fund is part of financial wellbeing, it would seems that people have become less obsessed with money and material things and more focused on living in the moment. Will that behavior last long after Covid? That’s tough to say. Just as major corporations are starting to force workers back into offices, the desire to buy material things might creep back into our brains.

One way to combat falling back into bad financial habits is to track your spending and monitor your net worth. If you know what you have, you will be able to make more mindful decisions on how you’re allocating your income. If you don’t use anything to track your personal finances, Personal Capital is actually a great place to start. They have a lot of free tools that can help you get your finances in order.