How To Use The Simple 50-30-20 Rule To Unlock Your Financial Freedom

Whether you’re using spreadsheets, software, envelopes, mason jars, or an old-school ledger, tracking a budget is a lot of work. To compound the problem, you’re essentially documenting all the fun things you’re not allowing yourself to do.

It’s way more enjoyable to spend money and let the chips fall where they may.

However, creating a budget allows you to have control over your finances and make intentional decisions that align with your long-term goals.

Sticking to a smart budget and saving money almost always leads to beautiful outcomes, like paying off your mortgage in five years with extreme measures, or building a healthy nest egg to last in retirement no matter where you live with a more relaxed approach.

If you prefer the latter, following a simple (even gimmicky!) plan might be the best path for you.

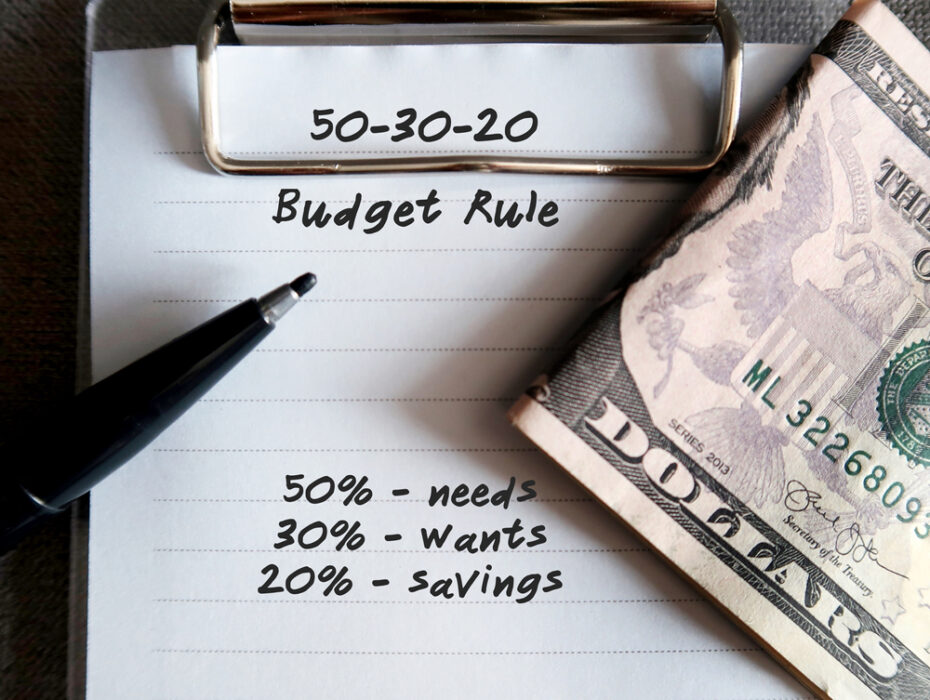

Today we’ll discuss one such method, the 50-30-20 Rule.

What Is The Purpose Of The 50-30-20 Rule?

The 50-30-20 rule is a budgeting strategy designed to help people manage after-tax income. And it’s so simple, yet so very effective for saving money. Which makes it easy for beginners to adhere to it.

This budgeting rule suggests that 50% of income should be spent on current needs, 30% on wants and 20% should be saved for future needs and emergencies. This strategy is often used to help people pay down debt and save for retirement.

The 50-30-20 Rule is also a way to help individuals stay within their budget and allocate their money more responsibly. And that can only be a good thing.

Let’s dive deeper, shall we? We shall!

The Building Block of Any Good Budget

Financial advisor Scott McLaine recently recorded a straightforward TikTok explaining the number one priority in his “5 Rules of Wealth”: Pay yourself first!

@brightwealth #budgeting #budgetingtips #budgeting101 #financetiktok #retirementplanning #retirementplan #retirementsavings #retirementfund #savingmoney #finance

Scott’s point is important here. And while the 50-30-20 Rule technically isn’t paying yourself “first,” it does allocate money for savings. In fact, more than Scott recommends in his hypothetical example.

Here’s how the 50-30-20 Rule works for each paycheck:

50% Of Your Paycheck

Allocate half your paycheck toward your essential costs. Rent/mortgage, utilities, food, transportation, insurance, and a monthly allocation to pay down debt.

The beautify of the “essential” category is it’s not nearly as rigid as you might think. Some items that once seemed frivolous can be allocated to “essential.” Who can get by these days without a mobile device? Internet? Certain software and apps? Clothes for work? A gym membership? These may all be designated “essential,” depending on your lifestyle.

The important thing is, once you categorize those items, stick to their placement in your budget. No take-backs!

30% Of Your Paycheck

Use this piece for things you want. This is a catch-all for anything you haven’t categorized as essential but isn’t saving or investing either.

Travel, entertainment (yes, all those streaming services), dining out, frivolous clothing purchases. You know, all the fun stuff.

You can even split certain items between “essential” and “wants” when you decide to treat yourself to an upgrade. Say you’re buying a car and you want to spring for a Lexus even though a reliable Honda Civic is all you need. Get the Lexus, allocate the estimated monthly payment for the Civic to “essential,” and put the rest in the “want” column. See, budgeting is fun now.

20% Of Your Paycheck

A full 20% of your paycheck should be saved and invested.

Your saving and investing strategy will vary based on age, family situation, whether your employer has a 401k match, and where you’re at in the saving process (get that emergency fund setup first!). But the important thing is that you’re setting aside a healthy percentage of your income for your future self.

Haggle all you want over the 80% being allocated to essentials and wants, but the 20% portion is the most essential piece of this puzzle. In fact, maybe it should be called the 20-30-50 Rule. Because you must pay yourself first.

The 50-30-20 Rule’s One Major Caveat

The distributions above are aligned with the term “paycheck” because the 50%, 30%, and 20% allocations only work with regards to take-home pay. After the IRS has its cut.

So if you’re a business owner or contractor who doesn’t receive a paycheck with taxes withheld, take that into account. Pay yourself first—after you pay the tax man.

Does The 50-30-20 Rule Work For Everyone?

The 50-30-20 Rule is a great way for people who dislike budgeting to chart a simple path toward financial freedom.

Does it work for everyone? No financial plan does.

And that’s an important point: The rigidity of the 50-30-20 plan is its biggest strength, as it sets a rules-based course for the financially disorganized, but it shouldn’t be a “set and forget” method for building wealth.

Use the 50-30-20 Plan to start down the path to financial freedom. Then research a plan more tailored to your life situation.