Financial Adviser On TikTok Explains Why ‘Saving What’s Leftover’ Is All Wrong For Building Wealth

So many people approach building wealth with the wrong mentality. They either (A. expect a sudden financial windfall or (B. refuse to commit to proven habits for saving and compounding.

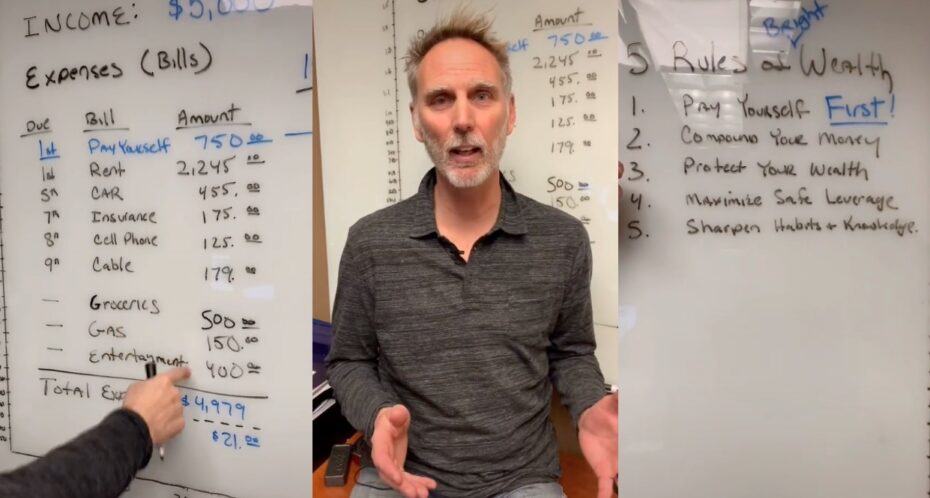

This all comes down to how one thinks about their monthly budget. Life has its fair share of hard costs – rent, a mortgage, insurance, car payment, phone bill, etc. One of those hard costs should be what you stash away for long-term wealth accumulation.

Many do not pay themselves first out of their monthly budget. Rather, they’ll simply save what’s left over after paying off expenses. This means the money going into a compound account can vary every month, which can cost you big bucks in the long term.

Slow, steady, and consistent wins the race. That’s why robo-investing tools like Acorns and Stash have become so popular amongst millennials.

Scott McLaine, a financial adviser at BrightWealth® Financial Services, put together a TikTok explaining why the approach above is all wrong.

The problem with the mindset of saving what’s leftover is that in some months, there isn’t anything left. Those who accumulate wealth in life have adopted the habit of paying themselves first. That’s why it’s rule number one on the 5 Rules Of Wealth.

McLaine – who previously provided a helpful TikTok breakdown of how tax brackets actually work – goes on to detail his rules for building wealth.

The 5 Rules Of Wealth

- Pay yourself first.

- Compound your money.

- Protect your wealth.

- Maximize safe leverage.

- Sharpen habits + knowledge

@brightwealth #budgeting #budgetingtips #budgeting101 #financetiktok #retirementplanning #retirementplan #retirementsavings #retirementfund #savingmoney #finance

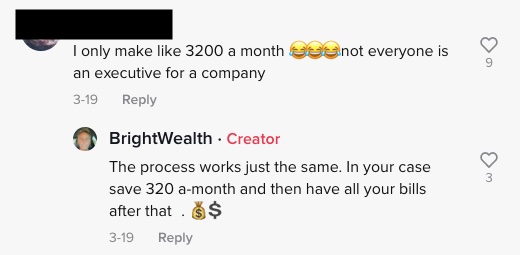

Don’t get hung up on McLaine’s example of $5,000. The same principle applies with less take home pay. It’s just a good habit to save 15% of your take home pay as early as possible. With the power of compound interest and time, that’s some serious money down the road of life.

For a more through explanation of the 5 Rules Of Wealth, check out Scott McLaine’s YouTube video on the subject.