What If You’d Invested $1,000 In Every Major Vaccine Stock At The Start of the Pandemic?

We don’t usually play the “What if?” game here at Wealth Gang – we’re typically focused on building wealth for your future. But what’s past is prologue, and there are lessons to be learned from looking back. Also, there’s a certain entertainment value in asking questions like, “What if I’d put $1,000 in each of the major vaccine stocks at the start of the pandemic?”

Investing in Vaccine Stocks

As you’re probably aware, the market was kind to anyone who spent the early days of the COVID-19 pandemic adhering to one of our favorites Warren Buffett investing quotes:

Be fearful when others are greedy, and greedy when others are fearful.

Easier said than done, of course. You’d be forgiven if you participated in the early 2020 market drawdown and put your money into safer assets.

But those who stuck it out were rewarded for their fortitude, and investors who caught the falling knife and actually poured money into the market did even better. Especially if they bought into certain pharmaceutical companies competing to produce a COVID-19 vaccine.

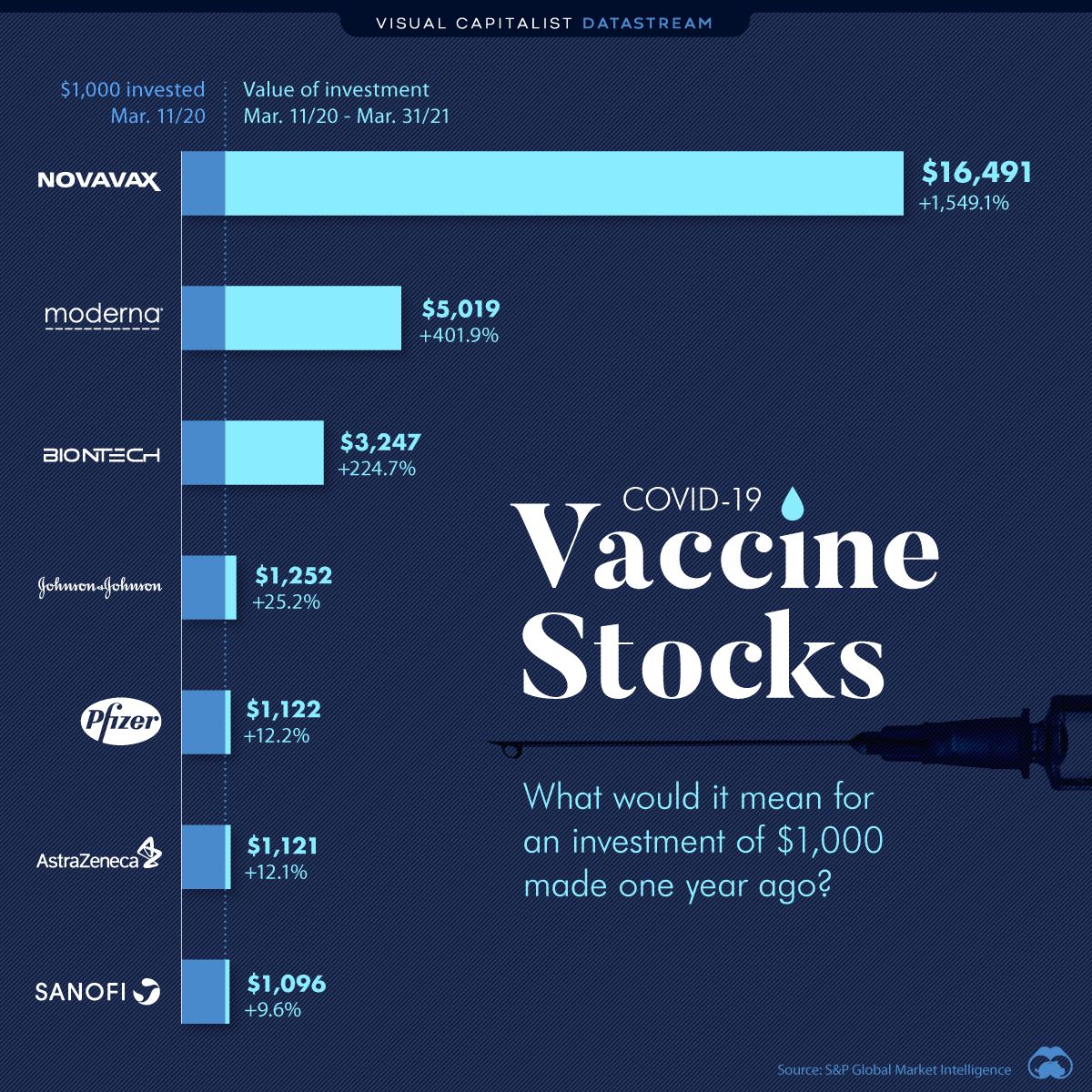

Courtesy of Visual Capitalist, here’s a look at how an early pandemic investment in each of those companies is looking now, a year later:

While some stocks were big winners (Novavax, Moderna, BioNTech), others had modest gains.

Vaccine Stocks vs. The Market

As always, relativity is important here. To say that holding any of these stocks is a “win” just because they went up is far from accurate.

The S&P 500 gained 45% during this same period, so pouring all of your money into Sanofi, Pfizer, AstraZeneca, and/or J&J would’ve made you an underperformer. Meanwhile, splashing your entire net worth into Novavax, Moderna, and/or BioNTech would’ve been a market-trouncing move.

How about a portfolio holding an equal position in all seven names?

A portfolio equally weight across Sanofi, Pfizer, AstraZeneca, Johnson & Johnson, Novavax, Moderna, and BioNTech on March 11 would be up 319% today.

Diversification—paired with a lot of fortitude—wins again.

More Investment Conversations

- How To Put Your Money To Work With Stash

The One Stock To Buy If You Want To Invest In The Gig Economy and Side Hustles

- Report: New Investors Are Learning Robinhood Tax Implications The Hard Way

- Mark Cuban Thinks The Number Of People Who Own Bitcoin Could More Than Double

- Best Countries To Invest In 2021, Other Than The United States

- 9 Investing Quotes You Should Know Before Putting A Single Dollar In The Stock Market