New Report Suggests You Need to Make Almost $100,000 A Year To Afford A New Car

If you’ve taken a stroll on a car dealership lot lately, you know how expensive new cars have become.

If the sticker shock didn’t knock you off your feet, the in-car tech might. Gone are the days of basic transport; now even the humblest hatchback thinks it’s part spaceship, boasting gadgets galore. And while we’re all for the future arriving early, it seems our wallets didn’t get the memo.

But let’s not just blame the tech. The global supply chain’s been acting like a moody teenager lately—especially where automotive bits and bobs are concerned. Microchip shortage? Check. Sluggish production? You bet. High demand? Absolutely. So, the next time you’re wondering why that new car’s price is sky-high, remember: it’s not just the fancy tech, it’s the world playing hard to get.

The Surging Costs of Modern Cars

Citing Kelly Bluebook Data,

These sky-high prices for a new car mean sky-high monthly payments for consumers.

According to Edmunds data cited by MarketWatch, the annual percentage rate for new-car loans averaged 7.4%, leading to record monthly payments of $736 in the third quarter. Used cars saw an average APR of 11.2% during the same period, resulting in average monthly payments of $567. MarketWatch also found a staggering data point about the number of people paying over $1000 a month for their ride: 17.5% of car purchasers had monthly payments exceeding $1,000 in the third quarter, which is a new all-time high from the prior record of 17.1% in the second quarter.

These numbers on monthly payments are pretty close to the findings by NerdWallet, citing data from Cox Automotive’s Sept. 2023 Industry Insights and Sales Forecast Call. NerdWallet reports marginally higher average monthly payments for new cars: $770, with used car average payments at $592.

Citing data from the American Automobile Association, MarketWatch found it costs an average of $12,182 per year to own a new car.

Breaking Down the Numbers: How Much Do You Really Need to Drive Off in That New Car?

In early September, former Ford CEO Mark Fields said “you have to make over $100 thousand per year to afford a new car right now.”

That math backs out if you follow the popular 20/4/10 rule rule for how much car you can afford, with 20% down payment, finance for 4 years, and monthly payments under 10% of income.

MarketWatch presents a hypothetical car-buying scenario for an average-priced new car at $48,000. If you reduce some money from a trade-in and finance at a $40,000 purchase price, with 7.5% interest for five years, this comes out to a $801 monthly payment. In order for this to be 10% of your monthly income, you need to make $96,100 a year.

Rethinking What Cars Are Truly Affordable

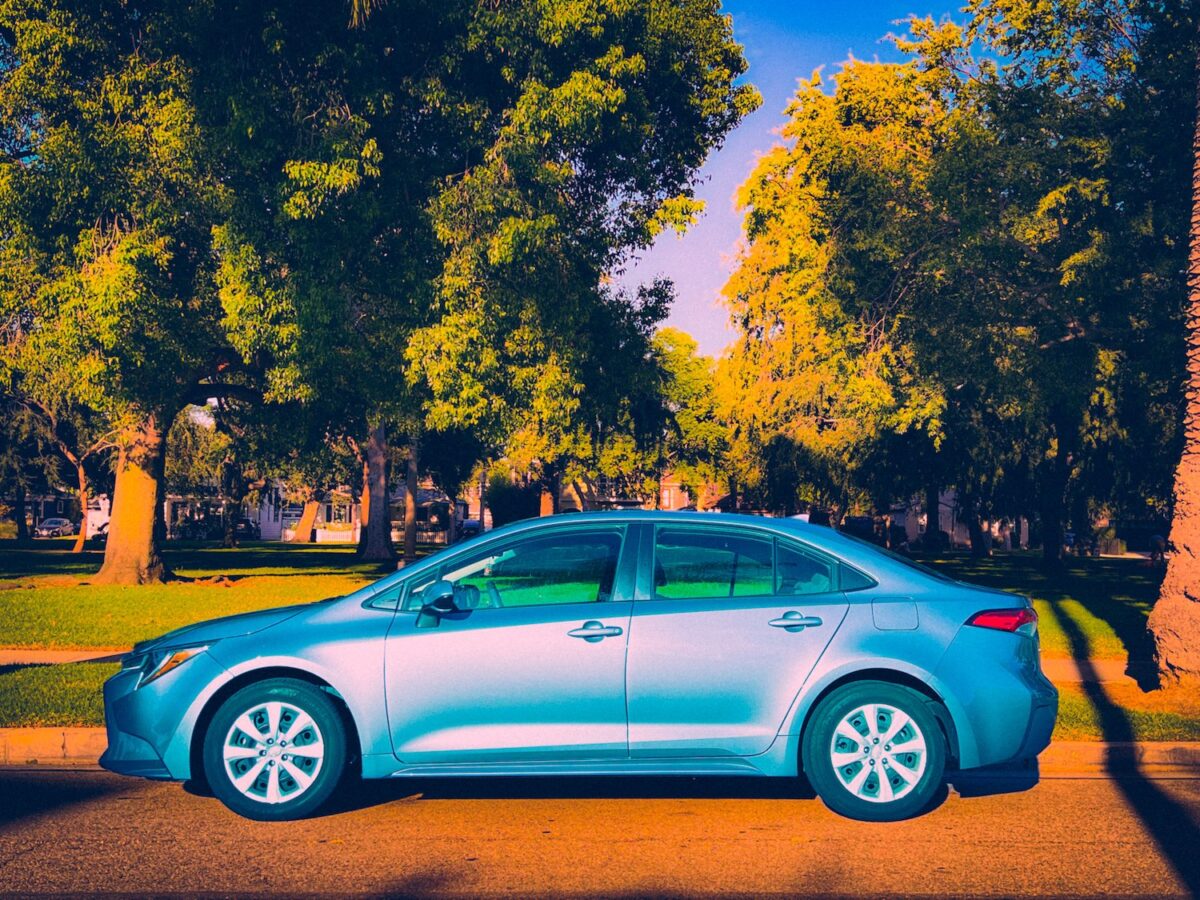

As prices and interest rates skyrocket, buying a relatively standard new car has become a significant financial decision. For example, the Toyota Corolla’s price tag has been a topic of recent discussion.

A couple months ago, a financially-savvy TikToker named Jaxon did the math and found that to comfortably afford a 2023 model based on the 20/4/10 Rule, one would need an annual income of about $72,000. This revelation sparked a conversation, particularly since the calculation doesn’t factor in taxes and dealer fees.

Some online commenters argue that the actual costs might be higher when other fees are considered. Additionally, there’s a sentiment that four-year car loans have become less common in 2023, questioning the relevance of the 20/4/10 Rule in current car buying decisions.

In conclusion, the decision to purchase a new car, even one as popular and affordable as the Toyota Corolla, requires careful financial evaluation. It’s essential to consider all costs and financing options before making a purchase.