The 3 Biggest Reasons Americans Can’t Save For Retirement

What if, when you first started working, someone handed you an exact blueprint on how to retire with millions of dollars? Would you be able to make the necessary sacrifices to save and invest? Or would you spend your 20s, and possibly your 30s, spending frivolously trying to keep up with the ever-so-famous Joneses?

Well, that financial freedom blueprint does exist. And thanks to numerous websites about personal finance, you don’t have to look very hard to find it. Then why is it that so many people still can’t save money for retirement?

The Biggest Reasons Americans Can’t Save for Retirement

Debt, Debt And More Debt

According to a recent study by Transamerica Center for Retirement Studies, an overwhelming percentage of Americans find it impossible to save for retirement because of debt. Car loans (or leases), student loan debt, mortgages, credit card debt…you name the type of debt and chances are that a lot of Americans are up to their eyeballs in it.

In fact, a whopping 49% of Americans cite debt as the main reason they have no nest egg to speak of. And it isn’t just the younger generations (Millennials and Gen-Z) who are most hampered by debt. An alarming amount of Baby Boomers and Gen-Xers are carrying more debt than is financially safe or reasonable.

When you break down debt worries by demographic groups, you can easily see that this isn’t a generational issue. And one of the biggest reasons Americans can’t save for retirement. In fact, according to this study, it is the biggest.

- Generation Z: 51%

- Millennials: 57%

- Generation X: 51%

- Baby boomers: 32%

48% Don’t Have Enough Income to Save for Retirement

It’s very easy to tell someone to spend less than you make. But when you are providing food, shelter and other basic necessities for yourself and your family, sometimes there isn’t much leftover. For almost half the population, that seems to be the case.

- Generation Z: 55%

- Millennials: 49%

- Generation X: 48%

- Baby boomers: 40%

Procrastination Is Killing A Lot Of Nest Eggs

Aaron Burr once said, “Never do today what you can put off till tomorrow. Delay may give clearer light as to what is best to be done.”

That quote by Aaron Burr might be true for a lot of things, but for 40% of Americans, that mentality could be destroying their shot at a healthy retirement.

- Generation Z: 57%

- Millennials: 48%

- Generation X: 38%

- Baby boomers: 23%

More Noteworthy Retirement Stats

What About Emergency Savings?

In the 3,000+ person study, Transamerica Center for Retirement Studies found that emergency savings, while not ideal, are also not as dire (under $1,000) as some articles and other studies have claimed.

- Generation Z: $2,000

- Millennials: $5,000

- Generation X: $6,000

- Baby boomers: $10,000

How Are Americans Saving For Retirement?

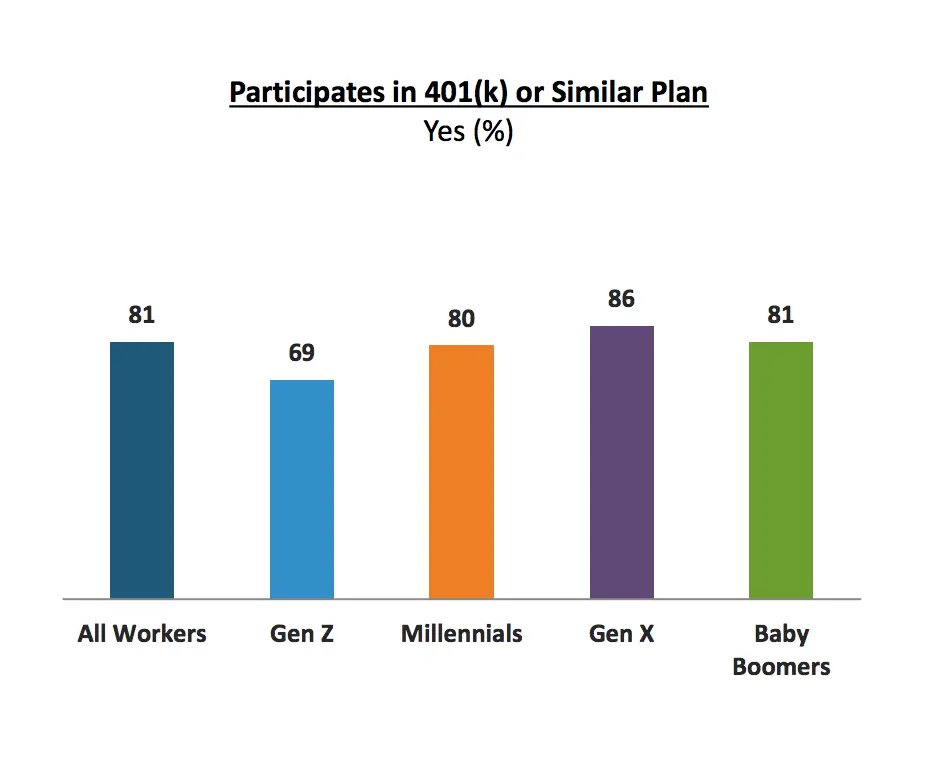

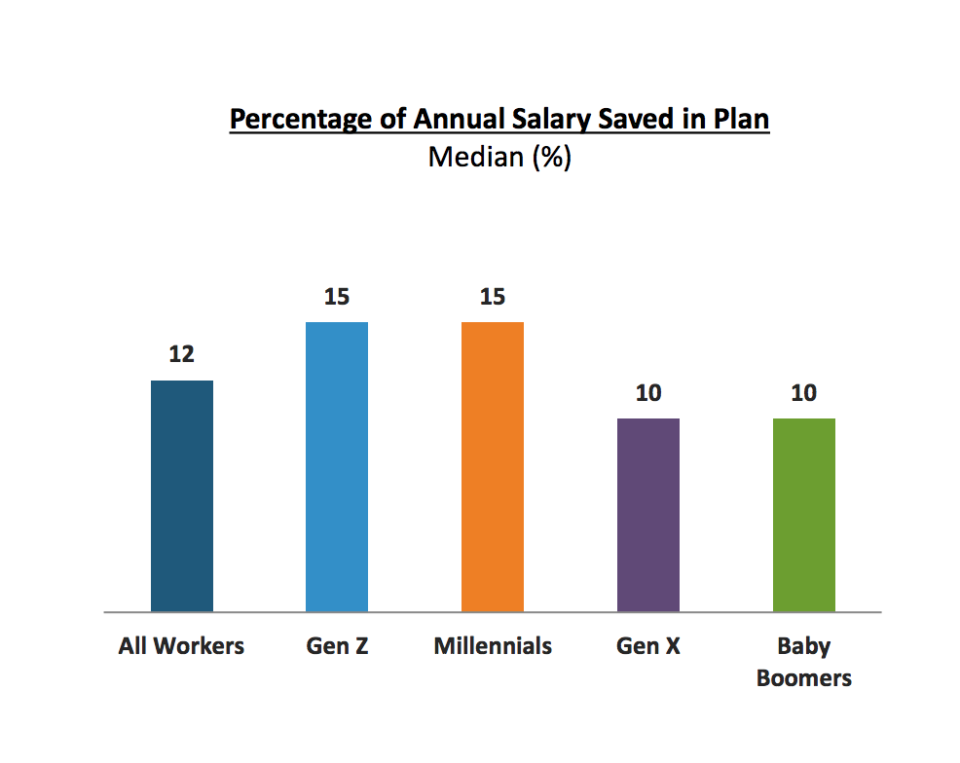

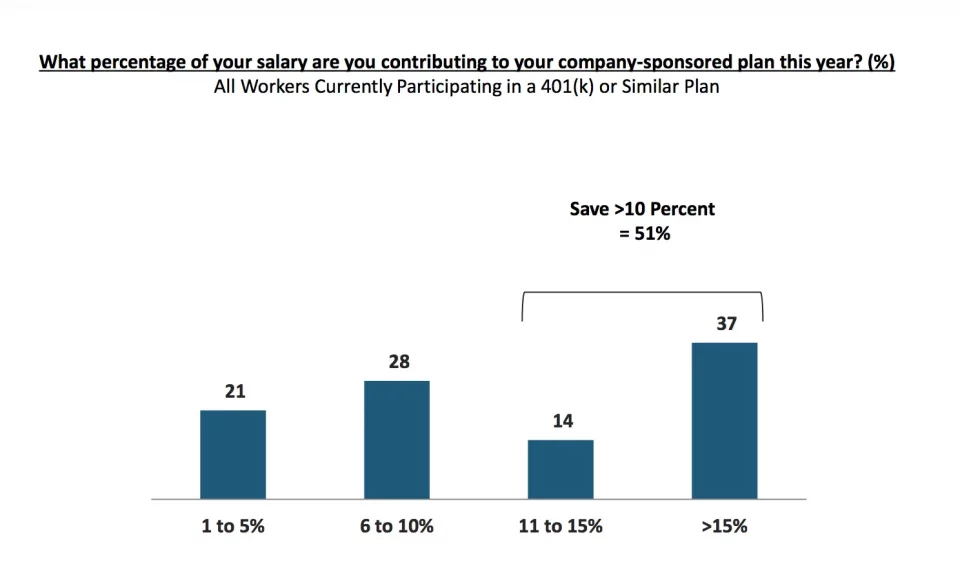

Based on the results of the study, while some situations aren’t ideal, most workers are taking advantage of retirement accounts. In fact, 81% of the people surveyed said they participate in a 401(K) or similar savings plan. Of those, about half are contributing more than 10% of their annual salary.

Even though it would seem that Americans are doing better at saving and investment for retirement, a lot of participants claimed they would hold off on retirement until age 65 and more than half believed they would have to continue to work into their golden years.

This is why we stress the importance of investing early and building passive income streams. Your retirement doesn’t have to be fraught with worry about running out of money. And the sooner you start and the more you invest every month, the better.